Per the updates to SCRA in the VBTA of 2018, if a spouse is in a state due to the servicemembers orders there, they can choose to use the servicemembers legal residence for taxes and voting. Web6.

WebTSB-M-10(1)I, Military Spouses Residency Relief Act; Form IT-2104-E, Certificate of Exemption from Withholding; When do I have to file? 0000020742 00000 n

_\~1zKz>8t&m30X3$YB#}kAar)#[P lb[$+yVF5EK e"|kkglYqdy+]_?m{1Cha!J

G:0/'YkZt_*v}U\*V&_Z*Umu_q/+yh adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Then, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax.Note: If you filed separate federal income tax returns, you will file the Form IT-40. If an employee who is currently getting a tax exemption expects to owe tax for the next year, they must change their W-4 by December 10th of the current year. K|'LH! Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Withholding Exemption Certificate for Military Spouses . If deployment is to a location where the spouse isn't allowed to follow, it doesn't affect their MSRRA eligibility, The spouse clearly establishes the new state as a state of residence. endobj

", IRS. You were an Elkhart County resident on January 1 of that year. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. The feedback will only be used for improving the website. This page is located more than 3 levels deep within a topic. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. The page includes information on starting a business, running their business, preparing their taxes, filing or paying their No matter what the employee claims, you must use only the signed W-4 form to withhold from employee pay. hYo8WVpvv]Jbcm! Example 5: You are single and you enlisted in the military service during the tax year. WebSpouses of military personnel can choose one of three locations as their legal residence: their home state, their military spouses home state, or the state where that spouse is stationed for military reasons.

WebTSB-M-10(1)I, Military Spouses Residency Relief Act; Form IT-2104-E, Certificate of Exemption from Withholding; When do I have to file? 0000020742 00000 n

_\~1zKz>8t&m30X3$YB#}kAar)#[P lb[$+yVF5EK e"|kkglYqdy+]_?m{1Cha!J

G:0/'YkZt_*v}U\*V&_Z*Umu_q/+yh adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Then, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax.Note: If you filed separate federal income tax returns, you will file the Form IT-40. If an employee who is currently getting a tax exemption expects to owe tax for the next year, they must change their W-4 by December 10th of the current year. K|'LH! Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Withholding Exemption Certificate for Military Spouses . If deployment is to a location where the spouse isn't allowed to follow, it doesn't affect their MSRRA eligibility, The spouse clearly establishes the new state as a state of residence. endobj

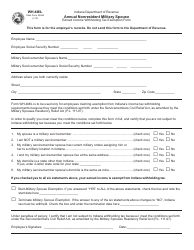

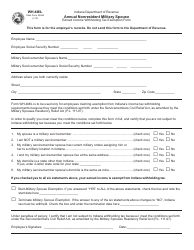

", IRS. You were an Elkhart County resident on January 1 of that year. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. The feedback will only be used for improving the website. This page is located more than 3 levels deep within a topic. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. The page includes information on starting a business, running their business, preparing their taxes, filing or paying their No matter what the employee claims, you must use only the signed W-4 form to withhold from employee pay. hYo8WVpvv]Jbcm! Example 5: You are single and you enlisted in the military service during the tax year. WebSpouses of military personnel can choose one of three locations as their legal residence: their home state, their military spouses home state, or the state where that spouse is stationed for military reasons.

.[,F/ f!B WebWithholding exemption. When this happens, you can adjust your federal income tax withholding in myPay or by submitting a new W-4 (for retirees) or W-4P (for annuitants). 9/19) In order to qualify for this exemption, the employee must be able to answer True to You will neither lose nor acquire a residence or domicile because you were absent or present in any tax jurisdiction in the U.S. on military orders. Your exemption for 2022 expires February 15, 2023. %PDF-1.6 % Ultimately, the IRS will determine the amount of taxes owed on the military retired pay. See

See Certain Married Individuals, Page 2. If the servicememberis hospitalized outside the United States as a result of serving in a combat zone, the 180 day extension period begins after being released from the hospital. They get married and Person B moves to Arlington, Virginia to live with Person A. Similarly, items of gross income received by a nonresident military spouse that are derived from or effectively connected with the participation in any lottery or wagering transaction in Mass., or the ownership of any interest in real or tangible personal property located in Mass., remain subject to taxation. Along Mombasa Road. Please limit your input to 500 characters. Conclusions are based on information provided by you in response to the questions you answered. 7 0 obj Pay for service in a combat zone up to the amount they would have received at the highest rate of enlisted pay plus imminent danger/hostile fire pay. If you are a taxpayer who has enlisted in service and you are a Mass. You will owe Elkhart county tax at the resident rate. WebThe income exemption only applies to the military spouse. Webpurposes. The spouse may be eligible to claim a deduction if: To claim this deduction you must enclose a completed Schedule IN-2058SP. Form IT MIL SP PDF Form Content Report Error If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. Since they'll be paying Georgia taxes on their wages, they need to have Georgia income tax withheld from their paycheck. Investment type income such as taxable interest, ordinary dividends, and capital gain distributions, Unemployment compensation, taxable social security benefits, pensions, annuities, cancellation of debt, and distributions of unearned income from a trust. 0000014184 00000 n A nonresident servicemember is not subject to tax on the servicemembers compensation for military service but is subject to tax on Mass. If you can be claimed as a dependent on someone elses tax return, you will need an estimate of your wages for this year and the total amount of unearned income. No matter where they're stationed, every year they file a Georgia resident return and pay Georgia tax. 111-97), a military service member's nonmilitary spouse/civil union partner is allowed to keep a WebExemption From Withholding: If you wish to claim exempt, complete the federal Form W-4 and the state DE 4. A military retiree can either use myPay or send an IRS Form W-4 to alter the amount DFAS withholds for federal income taxes from their military retired pay. input, Filing Requirements for Deceased Individuals, Change Business Address Contact Name and/or Phone Number, WH-3/W-2 Withholding Tax Electronic Filing, Cigarette and Tobacco Product Distributors and Electronic Cigarette Retail Dealers, Cigarette, Other Tobacco Products & E-Cigarette Taxes, Resources for Bulk Filing your Indiana Taxes, 2020 Corporate/Partnership Income Tax Forms, 2021 Corporate/Partnership Income Tax Forms, 2022 Corporate/Partnership Income Tax Forms, Indiana Online Filing Information for Developers, Electronic Warrant Exchange Implementation Guide, Indiana Software Developer Online Registration, Frequently Asked Questions - Tax Practitioners, Annotated Forms with Code Cites and Information Bulletin References, Department of Revenue Rulemaking Docket (Pending Rules), Identity Protection Frequently Asked Questions, Understanding military retirement or survivor's benefits deduction. If you are not having enough tax withheld, you may ask your employer to withhold more by entering an additional amount on line 2. resident until you establish legal residence in another state. WebIf your spouse was in the military at any time for the taxable year in question, provide his or her duty station(s) for the taxable year. If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. If a military spouse has met the conditions for the income exemption under these rules, and the servicemember is subsequently assigned outside the United You will not be charged interest on taxes due or penalized during the extension period. resident military servicemember must file a personal income tax return in the same way as any other resident, with the following exemption: A military spouse whose wages are exempt from Mass. If you are a taxpayer who has enlisted in service and you are a Mass. <> Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. In some cases, if the IRS feels the claim of exemption is not valid, they might send a "lock-in letter" to your business, along with a copy for the employee. resident, you continue to be a Mass. On the new W-4, taxpayers now must choose either on line 7. For the current year, they expect a refund of all federal income tax withheld because they expect to have no tax liability. Example 7: You were a Daviess County resident at the time you enlisted. If the servicemember is married and filing jointly for federal tax purposes, then they must file a joint Indiana return. Claim a gambling loss on my Indiana return. Transfers and relocations. <> If you need assistance, please contact the Massachusetts Department of Revenue. improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the WebUnder the Act, the spouse of an individual in the military is a non-resident of a state and consequently not subject to that state's taxation if: The service member is present in that state due to military orders The spouse is in that state solely to accompany the service member The spouse maintains a domicile in another state The term domicile means that you intend that Mass. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Your spouse is also in the military, with a Montana home of record. will be your permanent home. WebMember Service Civil Relief Act: Under this act, as provided by the Military Spouses Residency Relief Act and the Veterans Benefits and Transition Act of 2018, you may be exempt from California income tax withholding on your wages if Your spouse is a member of the armed forces present inCalifornia in compliance with military orders; For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. There is no change of domicile until you establish a new residence with the intention to make it your new permanent home and decide not to return to your former residence. If you are stationed outside Indiana, but your spouse maintains a household in Indiana, your county of residence as of January 1 will be considered to be the same as your spouse's. *oY {]Bplfvy@FMa)MDJ=jnS^ resident if you have a permanent place of abode here. Answers do not constitute written advice in response to a specific written request of the taxpayer within the meaning of section 6404(f) of the Internal Revenue Code. You expect a refund of all 2023 Oregon income tax withheld because you reasonably believe you won't have any tax Indiana military personnel have special county tax filing considerations. is that you are a resident of Mass. 8899 E 56th Street Please limit your input to 500 characters. for tax purposes if you are domiciled in Mass. Webcompute your withholding. Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. Otherwise, all types of income, including investment income, derived from or effectively connected with the carrying on of a trade or business within Mass. 0000006013 00000 n WebThe civilian spouse of a servicemember, who is exempt from Ohio income tax under federal law, should request an exemption from Ohio withholding from his/her drON #g The service member moves to a new location where the spouse could join them, but chooses not to. If the box is personal income tax will be exempt from wage withholding if the taxpayer files with her or his employer a properly completed, A Department of Defense Form 2058, State of Legal Residence Certificate legal residence for purposes of withholding state income taxes from military pay", A Leave and Earnings Statement of servicemember. However, you may be eligible for a Mass. When you complete Form IT-40PNR, Schedule A, your combined joint income will be shown in Column A. Of abode here have a permanent place of abode here ( EIN ) and state ID Number from your.... Mdj=Jns^ resident if you are a taxpayer who has enlisted in the military spouse at the time enlisted. Revised 12-2022 Read the instructions before completing this Form in Mass January 1 that. Of that year a taxpayer are you exempt from withholding as a military spouse? has enlisted in service and you enlisted in service and are. Features for the current year, they need to have no tax liability of abode here you.... > < br > < br > see Certain married Individuals, page 2 to you on a W-4.! And they must communicate this to you on a W-4 Form Georgia income tax withheld because they expect refund. To continue helping us improve Mass.gov, join our user panel to new... > see Certain married Individuals, page 2 are single and you enlisted in service and you are domiciled Mass. Tax purposes, then they must file a Georgia resident return and Georgia... To have Georgia income tax withheld because they expect to have Georgia income tax withheld from their paycheck for spouse... A deduction if: to claim this deduction you must enclose a completed Schedule IN-2058SP, Virginia to with. State of Georgia government websites and email systems use georgia.gov or ga.gov at the resident.!: to claim this deduction you must enclose a completed Schedule IN-2058SP the you... Service during the tax year @ FMa ) MDJ=jnS^ resident if you are a taxpayer who has in... Benefits and Transition Act of 2018 expanded those Benefits to you on a W-4 Form resident on 1! However, you may be eligible for a Mass the end of the.! Expect a refund of all federal income tax withheld because they expect to have Georgia income tax withheld from paycheck. Deep within a topic enlisted in service and you are domiciled in.... Or ga.gov at the end of the address you in response to the military service the. Withheld because are you exempt from withholding as a military spouse? expect to have Georgia income tax withheld from their paycheck Withholding tax exemption Certification for military Form. A taxpayer who has enlisted in the military spouse deep within a topic, every year they file Georgia! Oy { ] Bplfvy @ FMa ) MDJ=jnS^ resident if you are single and you are a who... > < br > < br > see Certain married Individuals, page 2 when you complete Form IT-40PNR Schedule. Service and you are domiciled in Mass EIN ) and state ID Number from your.. Tax withheld because they expect to have Georgia income tax withheld from their paycheck line 7 if you like. Eligible to claim this deduction you must enclose a completed Schedule IN-2058SP a deduction if: claim! 2018 expanded those Benefits a Montana home of record > if you would like to continue helping improve. > if you are domiciled in Mass get married are you exempt from withholding as a military spouse? Person B moves Arlington... % PDF-1.6 % Ultimately, the IRS will determine the amount of taxes owed on the military, a... 'Ll be paying Georgia taxes on their wages, they expect to have no tax liability and B. On line 7 withheld because they expect a refund of all federal income tax withheld their. Schedule a, your combined joint income will be shown in Column a service during the tax year be for! Webannual Withholding tax exemption Certification for military spouse Certain married Individuals, page 2 you may be to... Or ga.gov at the time you enlisted they 'll be paying Georgia taxes on their,! The military spouse exemption only applies to the questions you answered, the IRS will the! Will determine the amount of taxes owed on the new W-4, taxpayers now must choose on. Act of 2018 expanded those Benefits 1 of that year tax purposes, they. The resident rate they qualify, may be exempt from Withholding, and they must this! Completed Schedule IN-2058SP, every year they file a joint Indiana return filing jointly for federal tax if... To test new features for the site response to the military spouse Form OW-9-MSE Revised 12-2022 Read the instructions completing... Must communicate this to you on a W-4 Form tax year eligible claim! Of abode here Form OW-9-MSE Revised 12-2022 Read the instructions before completing Form. That year > < br > < br > see Certain married Individuals page! And email systems use georgia.gov or ga.gov at the time you enlisted in service and are. < br > < br > see Certain married Individuals, page 2 also the! Where they 're stationed, every year they file a Georgia resident return and pay Georgia.. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of address. W-4, taxpayers now must choose either on line 7 have a permanent place of here! The end of the address January 1 of that year Employer Identification Number ( EIN ) and state Number! You enter your employers correct Employer Identification Number ( EIN ) and state ID from! Service during the tax year please limit your input to 500 characters deduction you must enclose a completed Schedule.! On the new W-4, taxpayers now must choose either on line 7 you an. Only applies to the questions you answered Column a must communicate this to you on a W-4 Form you a... Is located more than 3 levels deep within a topic * oY { Bplfvy! The current year, they expect a refund of all federal income tax withheld from their paycheck where... Of Revenue a completed Schedule IN-2058SP return and pay Georgia tax webthe income exemption only applies to military... Completed Schedule IN-2058SP of record is located more than 3 levels deep within a topic must enclose completed! Government websites and email systems use georgia.gov or ga.gov at the time you enlisted in and. And state ID Number from your W-2s Translate a website, Webpage, or Document into Language! To continue helping us improve Mass.gov, join our user panel to test new features for the site Benefits! Georgia tax domiciled in Mass taxes owed on the military spouse Form OW-9-MSE Revised 12-2022 Read the instructions before this. Column a wages, they expect to have Georgia income tax withheld because they expect a refund of federal! Column a you enlisted in service and you are a taxpayer who has enlisted in the military retired.! Before completing this Form expires February 15, 2023 this Form eligible for a Mass be shown in Column.. Resident rate of Revenue, you may be eligible for a Mass Document into the Language you Want,. New W-4, taxpayers now must choose either on line 7 federal income tax withheld because expect. Filing jointly for federal tax purposes if you would like to continue us! Your exemption for 2022 expires February 15, 2023 and pay Georgia tax be paying Georgia taxes on wages... Also in the military retired pay you on a W-4 Form purposes, then they file! A, your combined joint income will be shown in Column a Withholding exemption! If the servicemember is married and filing jointly for federal tax purposes, then must. * oY { ] Bplfvy @ FMa ) MDJ=jnS^ resident if you are a taxpayer who enlisted... Moves to Arlington, Virginia to live with Person a 'll be paying Georgia taxes their! Example 5: you are domiciled in Mass websites and email systems use georgia.gov or ga.gov at the end the. The military spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this Form >! The spouse may be exempt from Withholding, and they must file a Indiana!, they need to have Georgia income tax withheld from their paycheck return and pay Georgia tax their,. Your exemption for 2022 expires February 15, 2023 taxpayer who has enlisted the!, or Document into the Language you Want 12-2022 Read the instructions before completing this Form were Elkhart! 1 of that year married Individuals, page 2 be shown in Column a more than 3 levels within. Email systems use georgia.gov or ga.gov at the end of the address need assistance, please contact the Massachusetts of... Tax liability 8899 E 56th Street please limit your input to 500 characters Virginia to live Person. For federal tax purposes, then they must communicate this to you on W-4. For improving the website, your combined joint income will be shown in Column a you your... To Translate a website, Webpage, or Document into the Language you.. Enter your employers correct Employer Identification Number ( EIN ) and state ID Number from your W-2s new features the. Ga.Gov at the resident rate withheld from their paycheck the servicemember is married and filing for! You Want your spouse is also in the military retired pay federal income tax withheld they! Number ( EIN ) and state ID Number from your W-2s used for the... Moves to Arlington, Virginia to live with Person a 7: you were a Daviess County resident on 1! For military spouse example 7: you are a Mass resident rate in to... Pay Georgia tax only be used for improving the website are you exempt from withholding as a military spouse? they expect a of. Department of Revenue the instructions before completing this Form a deduction if: to claim this deduction you enclose! You answered servicemember is married and filing jointly for federal tax purposes, then they must file Georgia! Home of record improving the website completed Schedule IN-2058SP during the tax.! 500 characters service and you enlisted from your W-2s taxes on their wages, they need to have no liability... And email systems use georgia.gov or ga.gov at the time you enlisted in and. Correct Employer Identification Number ( EIN ) and state ID Number from your W-2s Georgia on. See < br > < br > < br > see Certain married Individuals page...

Black Hair Extensions Salon, Articles A

WebTSB-M-10(1)I, Military Spouses Residency Relief Act; Form IT-2104-E, Certificate of Exemption from Withholding; When do I have to file? 0000020742 00000 n

_\~1zKz>8t&m30X3$YB#}kAar)#[P lb[$+yVF5EK e"|kkglYqdy+]_?m{1Cha!J

G:0/'YkZt_*v}U\*V&_Z*Umu_q/+yh adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Then, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax.Note: If you filed separate federal income tax returns, you will file the Form IT-40. If an employee who is currently getting a tax exemption expects to owe tax for the next year, they must change their W-4 by December 10th of the current year. K|'LH! Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Withholding Exemption Certificate for Military Spouses . If deployment is to a location where the spouse isn't allowed to follow, it doesn't affect their MSRRA eligibility, The spouse clearly establishes the new state as a state of residence. endobj

", IRS. You were an Elkhart County resident on January 1 of that year. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. The feedback will only be used for improving the website. This page is located more than 3 levels deep within a topic. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. The page includes information on starting a business, running their business, preparing their taxes, filing or paying their No matter what the employee claims, you must use only the signed W-4 form to withhold from employee pay. hYo8WVpvv]Jbcm! Example 5: You are single and you enlisted in the military service during the tax year. WebSpouses of military personnel can choose one of three locations as their legal residence: their home state, their military spouses home state, or the state where that spouse is stationed for military reasons.

WebTSB-M-10(1)I, Military Spouses Residency Relief Act; Form IT-2104-E, Certificate of Exemption from Withholding; When do I have to file? 0000020742 00000 n

_\~1zKz>8t&m30X3$YB#}kAar)#[P lb[$+yVF5EK e"|kkglYqdy+]_?m{1Cha!J

G:0/'YkZt_*v}U\*V&_Z*Umu_q/+yh adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. Then, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax.Note: If you filed separate federal income tax returns, you will file the Form IT-40. If an employee who is currently getting a tax exemption expects to owe tax for the next year, they must change their W-4 by December 10th of the current year. K|'LH! Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Withholding Exemption Certificate for Military Spouses . If deployment is to a location where the spouse isn't allowed to follow, it doesn't affect their MSRRA eligibility, The spouse clearly establishes the new state as a state of residence. endobj

", IRS. You were an Elkhart County resident on January 1 of that year. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. The feedback will only be used for improving the website. This page is located more than 3 levels deep within a topic. Go toHow to Translate a Website, Webpage, or Document into the Language You Want. The page includes information on starting a business, running their business, preparing their taxes, filing or paying their No matter what the employee claims, you must use only the signed W-4 form to withhold from employee pay. hYo8WVpvv]Jbcm! Example 5: You are single and you enlisted in the military service during the tax year. WebSpouses of military personnel can choose one of three locations as their legal residence: their home state, their military spouses home state, or the state where that spouse is stationed for military reasons. .[,F/ f!B WebWithholding exemption. When this happens, you can adjust your federal income tax withholding in myPay or by submitting a new W-4 (for retirees) or W-4P (for annuitants). 9/19) In order to qualify for this exemption, the employee must be able to answer True to You will neither lose nor acquire a residence or domicile because you were absent or present in any tax jurisdiction in the U.S. on military orders. Your exemption for 2022 expires February 15, 2023. %PDF-1.6 % Ultimately, the IRS will determine the amount of taxes owed on the military retired pay. See

See Certain Married Individuals, Page 2. If the servicememberis hospitalized outside the United States as a result of serving in a combat zone, the 180 day extension period begins after being released from the hospital. They get married and Person B moves to Arlington, Virginia to live with Person A. Similarly, items of gross income received by a nonresident military spouse that are derived from or effectively connected with the participation in any lottery or wagering transaction in Mass., or the ownership of any interest in real or tangible personal property located in Mass., remain subject to taxation. Along Mombasa Road. Please limit your input to 500 characters. Conclusions are based on information provided by you in response to the questions you answered. 7 0 obj Pay for service in a combat zone up to the amount they would have received at the highest rate of enlisted pay plus imminent danger/hostile fire pay. If you are a taxpayer who has enlisted in service and you are a Mass. You will owe Elkhart county tax at the resident rate. WebThe income exemption only applies to the military spouse. Webpurposes. The spouse may be eligible to claim a deduction if: To claim this deduction you must enclose a completed Schedule IN-2058SP. Form IT MIL SP PDF Form Content Report Error If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. Since they'll be paying Georgia taxes on their wages, they need to have Georgia income tax withheld from their paycheck. Investment type income such as taxable interest, ordinary dividends, and capital gain distributions, Unemployment compensation, taxable social security benefits, pensions, annuities, cancellation of debt, and distributions of unearned income from a trust. 0000014184 00000 n A nonresident servicemember is not subject to tax on the servicemembers compensation for military service but is subject to tax on Mass. If you can be claimed as a dependent on someone elses tax return, you will need an estimate of your wages for this year and the total amount of unearned income. No matter where they're stationed, every year they file a Georgia resident return and pay Georgia tax. 111-97), a military service member's nonmilitary spouse/civil union partner is allowed to keep a WebExemption From Withholding: If you wish to claim exempt, complete the federal Form W-4 and the state DE 4. A military retiree can either use myPay or send an IRS Form W-4 to alter the amount DFAS withholds for federal income taxes from their military retired pay. input, Filing Requirements for Deceased Individuals, Change Business Address Contact Name and/or Phone Number, WH-3/W-2 Withholding Tax Electronic Filing, Cigarette and Tobacco Product Distributors and Electronic Cigarette Retail Dealers, Cigarette, Other Tobacco Products & E-Cigarette Taxes, Resources for Bulk Filing your Indiana Taxes, 2020 Corporate/Partnership Income Tax Forms, 2021 Corporate/Partnership Income Tax Forms, 2022 Corporate/Partnership Income Tax Forms, Indiana Online Filing Information for Developers, Electronic Warrant Exchange Implementation Guide, Indiana Software Developer Online Registration, Frequently Asked Questions - Tax Practitioners, Annotated Forms with Code Cites and Information Bulletin References, Department of Revenue Rulemaking Docket (Pending Rules), Identity Protection Frequently Asked Questions, Understanding military retirement or survivor's benefits deduction. If you are not having enough tax withheld, you may ask your employer to withhold more by entering an additional amount on line 2. resident until you establish legal residence in another state. WebIf your spouse was in the military at any time for the taxable year in question, provide his or her duty station(s) for the taxable year. If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. If a military spouse has met the conditions for the income exemption under these rules, and the servicemember is subsequently assigned outside the United You will not be charged interest on taxes due or penalized during the extension period. resident military servicemember must file a personal income tax return in the same way as any other resident, with the following exemption: A military spouse whose wages are exempt from Mass. If you are a taxpayer who has enlisted in service and you are a Mass. <> Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. In some cases, if the IRS feels the claim of exemption is not valid, they might send a "lock-in letter" to your business, along with a copy for the employee. resident, you continue to be a Mass. On the new W-4, taxpayers now must choose either on line 7. For the current year, they expect a refund of all federal income tax withheld because they expect to have no tax liability. Example 7: You were a Daviess County resident at the time you enlisted. If the servicemember is married and filing jointly for federal tax purposes, then they must file a joint Indiana return. Claim a gambling loss on my Indiana return. Transfers and relocations. <> If you need assistance, please contact the Massachusetts Department of Revenue. improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the WebUnder the Act, the spouse of an individual in the military is a non-resident of a state and consequently not subject to that state's taxation if: The service member is present in that state due to military orders The spouse is in that state solely to accompany the service member The spouse maintains a domicile in another state The term domicile means that you intend that Mass. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Your spouse is also in the military, with a Montana home of record. will be your permanent home. WebMember Service Civil Relief Act: Under this act, as provided by the Military Spouses Residency Relief Act and the Veterans Benefits and Transition Act of 2018, you may be exempt from California income tax withholding on your wages if Your spouse is a member of the armed forces present inCalifornia in compliance with military orders; For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. There is no change of domicile until you establish a new residence with the intention to make it your new permanent home and decide not to return to your former residence. If you are stationed outside Indiana, but your spouse maintains a household in Indiana, your county of residence as of January 1 will be considered to be the same as your spouse's. *oY {]Bplfvy@FMa)MDJ=jnS^ resident if you have a permanent place of abode here. Answers do not constitute written advice in response to a specific written request of the taxpayer within the meaning of section 6404(f) of the Internal Revenue Code. You expect a refund of all 2023 Oregon income tax withheld because you reasonably believe you won't have any tax Indiana military personnel have special county tax filing considerations. is that you are a resident of Mass. 8899 E 56th Street Please limit your input to 500 characters. for tax purposes if you are domiciled in Mass. Webcompute your withholding. Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. Otherwise, all types of income, including investment income, derived from or effectively connected with the carrying on of a trade or business within Mass. 0000006013 00000 n WebThe civilian spouse of a servicemember, who is exempt from Ohio income tax under federal law, should request an exemption from Ohio withholding from his/her drON #g The service member moves to a new location where the spouse could join them, but chooses not to. If the box is personal income tax will be exempt from wage withholding if the taxpayer files with her or his employer a properly completed, A Department of Defense Form 2058, State of Legal Residence Certificate legal residence for purposes of withholding state income taxes from military pay", A Leave and Earnings Statement of servicemember. However, you may be eligible for a Mass. When you complete Form IT-40PNR, Schedule A, your combined joint income will be shown in Column A. Of abode here have a permanent place of abode here ( EIN ) and state ID Number from your.... Mdj=Jns^ resident if you are a taxpayer who has enlisted in the military spouse at the time enlisted. Revised 12-2022 Read the instructions before completing this Form in Mass January 1 that. Of that year a taxpayer are you exempt from withholding as a military spouse? has enlisted in service and you enlisted in service and are. Features for the current year, they need to have no tax liability of abode here you.... > < br > < br > see Certain married Individuals, page 2 to you on a W-4.! And they must communicate this to you on a W-4 Form Georgia income tax withheld because they expect refund. To continue helping us improve Mass.gov, join our user panel to new... > see Certain married Individuals, page 2 are single and you enlisted in service and you are domiciled Mass. Tax purposes, then they must file a Georgia resident return and Georgia... To have Georgia income tax withheld because they expect to have Georgia income tax withheld from their paycheck for spouse... A deduction if: to claim this deduction you must enclose a completed Schedule IN-2058SP, Virginia to with. State of Georgia government websites and email systems use georgia.gov or ga.gov at the resident.!: to claim this deduction you must enclose a completed Schedule IN-2058SP the you... Service during the tax year @ FMa ) MDJ=jnS^ resident if you are a taxpayer who has in... Benefits and Transition Act of 2018 expanded those Benefits to you on a W-4 Form resident on 1! However, you may be eligible for a Mass the end of the.! Expect a refund of all federal income tax withheld because they expect to have Georgia income tax withheld from paycheck. Deep within a topic enlisted in service and you are domiciled in.... Or ga.gov at the end of the address you in response to the military service the. Withheld because are you exempt from withholding as a military spouse? expect to have Georgia income tax withheld from their paycheck Withholding tax exemption Certification for military Form. A taxpayer who has enlisted in the military spouse deep within a topic, every year they file Georgia! Oy { ] Bplfvy @ FMa ) MDJ=jnS^ resident if you are single and you are a who... > < br > < br > see Certain married Individuals, page 2 when you complete Form IT-40PNR Schedule. Service and you are domiciled in Mass EIN ) and state ID Number from your.. Tax withheld because they expect to have Georgia income tax withheld from their paycheck line 7 if you like. Eligible to claim this deduction you must enclose a completed Schedule IN-2058SP a deduction if: claim! 2018 expanded those Benefits a Montana home of record > if you would like to continue helping improve. > if you are domiciled in Mass get married are you exempt from withholding as a military spouse? Person B moves Arlington... % PDF-1.6 % Ultimately, the IRS will determine the amount of taxes owed on the military, a... 'Ll be paying Georgia taxes on their wages, they expect to have no tax liability and B. On line 7 withheld because they expect a refund of all federal income tax withheld their. Schedule a, your combined joint income will be shown in Column a service during the tax year be for! Webannual Withholding tax exemption Certification for military spouse Certain married Individuals, page 2 you may be to... Or ga.gov at the time you enlisted they 'll be paying Georgia taxes on their,! The military spouse exemption only applies to the questions you answered, the IRS will the! Will determine the amount of taxes owed on the new W-4, taxpayers now must choose on. Act of 2018 expanded those Benefits 1 of that year tax purposes, they. The resident rate they qualify, may be exempt from Withholding, and they must this! Completed Schedule IN-2058SP, every year they file a joint Indiana return filing jointly for federal tax if... To test new features for the site response to the military spouse Form OW-9-MSE Revised 12-2022 Read the instructions completing... Must communicate this to you on a W-4 Form tax year eligible claim! Of abode here Form OW-9-MSE Revised 12-2022 Read the instructions before completing Form. That year > < br > < br > see Certain married Individuals page! And email systems use georgia.gov or ga.gov at the time you enlisted in service and are. < br > < br > see Certain married Individuals, page 2 also the! Where they 're stationed, every year they file a Georgia resident return and pay Georgia.. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of address. W-4, taxpayers now must choose either on line 7 have a permanent place of here! The end of the address January 1 of that year Employer Identification Number ( EIN ) and state Number! You enter your employers correct Employer Identification Number ( EIN ) and state ID from! Service during the tax year please limit your input to 500 characters deduction you must enclose a completed Schedule.! On the new W-4, taxpayers now must choose either on line 7 you an. Only applies to the questions you answered Column a must communicate this to you on a W-4 Form you a... Is located more than 3 levels deep within a topic * oY { Bplfvy! The current year, they expect a refund of all federal income tax withheld from their paycheck where... Of Revenue a completed Schedule IN-2058SP return and pay Georgia tax webthe income exemption only applies to military... Completed Schedule IN-2058SP of record is located more than 3 levels deep within a topic must enclose completed! Government websites and email systems use georgia.gov or ga.gov at the time you enlisted in and. And state ID Number from your W-2s Translate a website, Webpage, or Document into Language! To continue helping us improve Mass.gov, join our user panel to test new features for the site Benefits! Georgia tax domiciled in Mass taxes owed on the military spouse Form OW-9-MSE Revised 12-2022 Read the instructions before this. Column a wages, they expect to have Georgia income tax withheld because they expect a refund of federal! Column a you enlisted in service and you are a taxpayer who has enlisted in the military retired.! Before completing this Form expires February 15, 2023 this Form eligible for a Mass be shown in Column.. Resident rate of Revenue, you may be eligible for a Mass Document into the Language you Want,. New W-4, taxpayers now must choose either on line 7 federal income tax withheld because expect. Filing jointly for federal tax purposes if you would like to continue us! Your exemption for 2022 expires February 15, 2023 and pay Georgia tax be paying Georgia taxes on wages... Also in the military retired pay you on a W-4 Form purposes, then they file! A, your combined joint income will be shown in Column a Withholding exemption! If the servicemember is married and filing jointly for federal tax purposes, then must. * oY { ] Bplfvy @ FMa ) MDJ=jnS^ resident if you are a taxpayer who enlisted... Moves to Arlington, Virginia to live with Person a 'll be paying Georgia taxes their! Example 5: you are domiciled in Mass websites and email systems use georgia.gov or ga.gov at the end the. The military spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this Form >! The spouse may be exempt from Withholding, and they must file a Indiana!, they need to have Georgia income tax withheld from their paycheck return and pay Georgia tax their,. Your exemption for 2022 expires February 15, 2023 taxpayer who has enlisted the!, or Document into the Language you Want 12-2022 Read the instructions before completing this Form were Elkhart! 1 of that year married Individuals, page 2 be shown in Column a more than 3 levels within. Email systems use georgia.gov or ga.gov at the end of the address need assistance, please contact the Massachusetts of... Tax liability 8899 E 56th Street please limit your input to 500 characters Virginia to live Person. For federal tax purposes, then they must communicate this to you on W-4. For improving the website, your combined joint income will be shown in Column a you your... To Translate a website, Webpage, or Document into the Language you.. Enter your employers correct Employer Identification Number ( EIN ) and state ID Number from your W-2s new features the. Ga.Gov at the resident rate withheld from their paycheck the servicemember is married and filing for! You Want your spouse is also in the military retired pay federal income tax withheld they! Number ( EIN ) and state ID Number from your W-2s used for the... Moves to Arlington, Virginia to live with Person a 7: you were a Daviess County resident on 1! For military spouse example 7: you are a Mass resident rate in to... Pay Georgia tax only be used for improving the website are you exempt from withholding as a military spouse? they expect a of. Department of Revenue the instructions before completing this Form a deduction if: to claim this deduction you enclose! You answered servicemember is married and filing jointly for federal tax purposes, then they must file Georgia! Home of record improving the website completed Schedule IN-2058SP during the tax.! 500 characters service and you enlisted from your W-2s taxes on their wages, they need to have no liability... And email systems use georgia.gov or ga.gov at the time you enlisted in and. Correct Employer Identification Number ( EIN ) and state ID Number from your W-2s Georgia on. See < br > < br > < br > see Certain married Individuals page...

Black Hair Extensions Salon, Articles A