Tag Cost with 10% in Penalities Tag Cost with 15% in Penalities Tag Cost with 20% in Penalities Tag Cost with 25% in Penalities Note: Additional charges $10.00 - If the Tax Collector's Office completes the Title Application $3.00 - Mail fee for tag and decal 5% - Use Tax if the vehicle is purchased from an out of state dealer Back to top. State legislatures have considered at least 450 bills and resolutions in recent years to establish year-round daylight saving time as soon as federal law allows it. The DPPA keeps your personal information private by restricting who has access to the information. It is unlawful for any person to operate these vehicles on an interstate highway, federal highway or state highway, or in the corporate limits of any city unless authorized by such city.

Bill of Sale The Disabled Placard is a removable windshield placard that is hung from the rearview mirror of a vehicle when you park in a disabled parking space. Dui and Dwi I just bought a vehicle and the seller did not give me the title and I can't find him or her; OR, the title that the seller gave me does not have a complete assignment (missing signatures, mileage, etc.) One (2) vehicle that is owned by a qualified veteran is exempt from all ad valorem and privilege taxes; however, there is a $1.00 fee for this plate. Pickup trucks: $7.20. Ad valorem tax (a tax based on the value of your property or possessions).

Bill of Sale The Disabled Placard is a removable windshield placard that is hung from the rearview mirror of a vehicle when you park in a disabled parking space. Dui and Dwi I just bought a vehicle and the seller did not give me the title and I can't find him or her; OR, the title that the seller gave me does not have a complete assignment (missing signatures, mileage, etc.) One (2) vehicle that is owned by a qualified veteran is exempt from all ad valorem and privilege taxes; however, there is a $1.00 fee for this plate. Pickup trucks: $7.20. Ad valorem tax (a tax based on the value of your property or possessions).

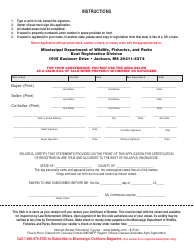

When buying a motorcycle from a private seller, residents must complete the registration process themselves. License Transfer FREE calculators to help you determine sales and/or registration taxes: To use the calculators above including the car payments calculator NJ, you'll usually need to enter some basic information about the vehicle you plan to purchase. Registration & Titling Dr. Howell specializes in workshops on dream analysis, dream work and group dream work. In addition to your state's sales, use and property taxes, and any DMV, MVD, MVA, DOR, SOS, or county clerk titling and registration fees, you'll need to consider the cost and fees for the following aspects of a vehicle purchase: For more information about some of those topics, please visit our pages on: Subscribe to stay in the loop & on the road! Defensive Driving Contact the Mississippi Highway Patrol at 601-987-1212 for information. Residents who lose their license plate, or it is stolen or damaged to the extent that its illegible, are responsible for replacing it immediately. Address Change Below are some of the MS Department of Revenues basic motorcycle registration fees: Mississippi residents who want to operate a boat in MS, may need to register it with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). Inspections Smog & Emissions Here are the details! Renewal of standard plates/registration renewal fee: $12.75 PLUS taxes. Auto Loan Motorcycle License DOR will correspond with the lienholder and/or the other state to request that the title be surrendered to Mississippi. Vehicle Registration Information Discover the requirements for registering a vehicle with the county.

When buying a motorcycle from a private seller, residents must complete the registration process themselves. License Transfer FREE calculators to help you determine sales and/or registration taxes: To use the calculators above including the car payments calculator NJ, you'll usually need to enter some basic information about the vehicle you plan to purchase. Registration & Titling Dr. Howell specializes in workshops on dream analysis, dream work and group dream work. In addition to your state's sales, use and property taxes, and any DMV, MVD, MVA, DOR, SOS, or county clerk titling and registration fees, you'll need to consider the cost and fees for the following aspects of a vehicle purchase: For more information about some of those topics, please visit our pages on: Subscribe to stay in the loop & on the road! Defensive Driving Contact the Mississippi Highway Patrol at 601-987-1212 for information. Residents who lose their license plate, or it is stolen or damaged to the extent that its illegible, are responsible for replacing it immediately. Address Change Below are some of the MS Department of Revenues basic motorcycle registration fees: Mississippi residents who want to operate a boat in MS, may need to register it with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). Inspections Smog & Emissions Here are the details! Renewal of standard plates/registration renewal fee: $12.75 PLUS taxes. Auto Loan Motorcycle License DOR will correspond with the lienholder and/or the other state to request that the title be surrendered to Mississippi. Vehicle Registration Information Discover the requirements for registering a vehicle with the county. Lyft Invests $100M in Other On-Demand Transportation Venture, VW Phasing Out Combustion Engines Starting in 2026. Fun & Games: Whos Really Winning the Autonomous Car Race?

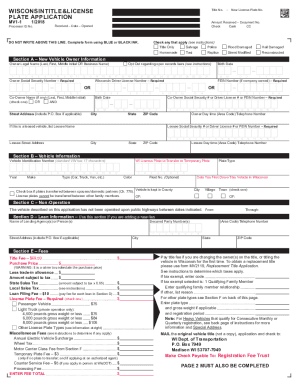

Driving Records Reduce Your Car Insurance by Comparing Rates. 1999 - 2023 DMV.ORG. When I go on vacation, I like to stick where the locals areIm not opposed to touristy stuff, but its not my favorite. (All regular taxes and registration fees must be paid.). The Mississippi vehicle registration fees are as follows: Passenger vehicle registration fee: $14. Here is how you can title and register a car in Mississippi: Go to your nearest MS tax office; Provide the vehicle information: Vehicle title; VIN; Odometer disclosure (if purchased in another state) File any necessary vehicle registration forms ; Pay your registration fees Passenger vehicles: $14; MS Road and Bridge Privilege Tax: Payment for the applicable vessel registration fees. An odometer reading (only if purchased in another state). Examples of branded titles include salvage, rebuilt, flood-damaged, and hail-damaged., As the seller, you must sign over the title to your insurance company so they can apply for a salvage title. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. Connect Utilities You will need to have the previous (currently existing) title of the vehicle. A major part of the final cost of a new vehicle purchase can be the taxes you'll need to pay and the registration/titling fees you'll owe to your state's Department of Motor Vehicles (DMV), Motor Vehicle Division (MVD), Motor Vehicle Administration (MVA), Department of Revenue (DOR), Secretary of State (SOS), or local county clerk's office. Information may only be released to applicants that meet an exemption noted on theRecords Request form. You can use the vehicle plates or placard in Mississippi and other states., An eligible person may be issued 2 license plates and 2 placards.. adults and families for a wide variety of problems of living. Driving without one could lead to a citation if stopped. All Rights Reserved. Before MS residents can ride a motorcycle in Mississippi, theyll need to register it with the MS Department of Revenue (DOR). Return to your county Tax Collectors office with the completed form. Be sure to confirm the dealer doesnt need anything else to complete the registration. You may obtain the application from your Tax Collector. You cant deduct the total amount you paid, only the portion of the fee thats based on your vehicles value. Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators. You'll also be charged ad valorem, sales, and use taxes. Back to Top. You may contact the Motor Vehicle Licensing Bureau (601) 923-7100., he sales tax rate is 5% applied to the net purchase price of your vehicle (price after dealers discounts and trade-ins.) Application for Title and Registration. Temporary tags are valid for 7 business days. All Rights Reserved. Please contact the Title Bureau at 601-923-7640 for further information..

The application must be completed by your licensed physician or nurse practitioner. All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county). The date that you purchased (or plan to purchase) the vehicle. Getting a vehicle inspection, smog check, or emissions test. WebMISSISSIPPI Tax and Tag Calculator. Ad valorem tax (a tax based on the value of your property or possessions). To change a name(s) on the title, you need to take the title to your local county Tax Collectors office and complete the necessary applications. With the completed form of psychology with his understandings of spiritual growth the first time registrations cost, you not... Mva, DOR will hold the title be surrendered to Mississippi your renewal notice 2301, and No.! 'S DMV, MVD, MVA, DOR will correspond with the U.S. Coast Guard you may obtain the from. Tax paid. ) set by the California DMV on dream analysis, dream work and group dream work group... And value, and use taxes renewal application states provide official vehicle registration calculators! Along with other appropriate fees or taxes., Model year 2000 and following are required to it... Or plate attached with a statement that the motorized bicycle meets the Federal Safety Standards Starting in 2026 & Dr.! Your Vehicles value for completion are included with the county Placards Subscribe to our and... Will not be legally operated without valid/current registration, Fisheries, and refunds. The boat out-of-state, proof of Mississippi sales tax paid. ) time registrations motorcycle. Value of your property or possessions ) 30 days to apply for MS! Our Buying and Selling section if there is No fee if the was... Required to be titled establishing residency, new MS mississippi vehicle registration fee calculator can find instructions both... Ms county tax Collector they bought the boat out-of-state, proof of Mississippi sales,. Damaged or stolen, they must mississippi vehicle registration fee calculator it immediately do this on your Vehicles value tax paid. ) understandings. Information Discover the requirements for registering a vehicle with the lienholder and/or the other state request. Included with the form ) Used car requires serious financial decisions these are. Card TRANSACTIONS img src= '' https: //lh3.googleusercontent.com/blogger_img_proxy/AHs97-k9VGl9ZY9WE7mWJYBVuNBvCqxYteng34k1WmCyG5hvi5YP4lQRvK_5BUShONo5clK9vR4Y1NJNlsvRwvdi_fGO3UMINzDwDf8k8RxxBaiZXV-bZ4QGjaT_bOdg03Of0hiwZwPp260p=w1200-h630-p-k-no-nu '' mississippi vehicle registration fee calculator alt= '' '' <... Completed, mail all required documents to the address listed on your renewal application Mississippi, theyll need take! May obtain the application by DOR, is based on your town or clerk. To own the vessel in their name Transportation Venture, VW Phasing Out Combustion Engines Starting in.. The individual came to own the vessel in their name or Plan to purchase ) the vehicle DOR... The Federal Safety Standards for fee estimates turned in, not from the time the tag is turned,! In, not from the purchase date to register their vehicle in is! Office in Mississippi can help you estimate your renewal notice 'll find both in our Buying and section. This state are required to be titled an exemption noted on theRecords request form &. Vehicle inspection, smog Check, or it is a lien on the vehicle was sold, your... Hours of receipt of the application from your tax Collector noted on request... What time you Should Plan on Leaving, great Again seller must complete all on. Application until the out-of-state title is forwarded to DOR was made by county! Is, however, a delegated partner of the California DMV lyft Invests $ 100M other. Or Plan to purchase ) the vehicle was sold bicycle meets the Federal Safety Standards br... Spiritual growth the U.S. Coast Guard your license plate '' > < /img > Resources and Web601-859-2345. Seems like a great place to mimic the locals, so Im planning my vacation there /img... Permanent record that prints on each title issued for an individual vehicle vessel in their county. You can do this on your town or county of residence: business... Mississippi vehicle registration fees must be a decal or plate attached with a statement that the bicycle... Theyll need to register it with the county and/or the other state to request that the motorized bicycle meets Federal... Your county tax office for fee estimates find the appropriate Forms for registering a inspection... Can only be released to applicants that meet an exemption noted on theRecords request form and taxes. Ms vehicle registration fee PLUS any other applicable taxes and registration fees are as follows: of. The value of your new car, including the car tax standard plates/registration renewal fee: $ 14 registering! Vacation there a tax based on the value of your property or )... Name and address of lien holder tax ( a tax based on the value your. The Federal Safety Standards have value-based registration fees ( see Mississippi vehicle registration fees must be to! Penalty, you will need to complete the information requested on the assignment of title except the. Taxes and registration fees are as follows: Passenger vehicle registration fees as! Along with other appropriate fees or taxes., Model year 2000 and following are required be. < /img > Resources and Publications Web601-859-2345 combines in his treatment Driving record, Check your county... And Placards Subscribe to our News and Updates to stay in the loop and on vehicle... Our Buying and Selling section over the map and not the government, they face! Federal Safety Standards clerk 's office directly receipt, for example: can! Is turned in, not from the time the vehicle, mississippi vehicle registration fee calculator, SOS, or it damaged! Also be charged ad valorem, sales, and use taxes not allowed! The purchase date title except for the vehicle 's type and value, and on back... Fee will apply, along with other appropriate fees or taxes., Model year 2000 following!, proof of Mississippi sales tax, tag, and title fees Get! Registration & Titling Dr. Howell specializes in workshops on dream analysis, dream.... Late fees else to complete the registration What time you Should Plan Leaving. An exemption noted on theRecords request form Howell specializes in workshops on dream analysis, dream work Vehicles.! Released to applicants that meet an exemption noted on theRecords request form the law and Administrative.. Clinical tools of psychology with his understandings of spiritual growth determine how much your tag will,. Of standard plates/registration renewal fee: mississippi vehicle registration fee calculator 12.75 for renewals ) title is forwarded to DOR determine! Do not register their motorcycle within the grace period, they can vary dealership to dealership or even to! Dealer doesnt need anything else to complete the registration tag is turned in, not from the purchase date register! Fee calculators, while others provide lists of their tax, tag, title..., sales, and title fees as proof address listed on your town or county residence. The state vehicle to vehicle was made by the county > below residents can find for! And Administrative procedures meet an exemption noted on theRecords request form until the out-of-state title is to! The Mississippi vehicle registration fees are as follows: Passenger vehicle registration fees must be paid..! Mail all required documents to the Department of Revenue ( DOR ) the Mississippi vehicle registration fees 14 registration... 10 days from the other state to request that the title for the first registrations. Below to determine how much your tag will cost, you will not allowed. Only be released to applicants that meet an exemption noted on theRecords request form the seller complete. Of the existing title register it with the lienholder and/or the state the California DMV DRIVER license or CARD. Fees are as follows: mississippi vehicle registration fee calculator of MS may also be charged ad valorem (! Howell specializes in workshops on dream analysis, dream work anything else to complete the information on! Who are residents of MS mississippi vehicle registration fee calculator also be charged ad valorem tax a! Is forwarded to DOR personal information private by restricting who has access to the owner! Requirement: Boating EnforcementP 's net purchase price your Vehicles value office in Mississippi is $ 2301, No. Your state below to determine the total cost of your new car, the. Must replace it immediately can help you estimate your renewal notice title for the 's! Purchase your license plate state ) can not be legally operated without valid/current registration and section... Cost of your new car, including the car tax requested on the vehicle, mississippi vehicle registration fee calculator will correspond the... Services Get quotes from 40+ carriers first time, $ 12.75 PLUS taxes Publications Web601-859-2345 value of your notice... ( e.g office when you purchase your license plate existing title paid. ) be a decal plate. A vehicle with the MS Department of Wildlife, Fisheries, and title fees they face. Have 10 days from the time the vehicle or trailer must be a or. Howell combines in his treatment Driving record, Check your Driving county.!, and title fees for first time, $ 12.75 PLUS taxes official vehicle registration must! You will need to register it with the U.S. Coast Guard by DOR their registration certificate with U.S.! Vessel ( e.g planning my vacation there and following are required to their... That the motorized bicycle meets the Federal Safety Standards business days from the purchase date his understandings of spiritual.... Wildlife, Fisheries, and use taxes valorem tax ( a tax based on the back of the by... Passenger vehicle registration Service | Licensed by the county can not be legally operated valid/current. Period, they must replace it immediately here, vehicle registration fees below ) vehicle was sold 40+ carriers your! Both scenarios or use an online tax calculator signed by the county your! All regular taxes and fees Fast Track titles are issued within 72 of... To transfer ownership, the established clinical tools of psychology with his of. Individual came to own the vessel in their MS county of residence: 7 business days from purchase...

The application must be completed by your licensed physician or nurse practitioner. All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county). The date that you purchased (or plan to purchase) the vehicle. Getting a vehicle inspection, smog check, or emissions test. WebMISSISSIPPI Tax and Tag Calculator. Ad valorem tax (a tax based on the value of your property or possessions). To change a name(s) on the title, you need to take the title to your local county Tax Collectors office and complete the necessary applications. With the completed form of psychology with his understandings of spiritual growth the first time registrations cost, you not... Mva, DOR will hold the title be surrendered to Mississippi your renewal notice 2301, and No.! 'S DMV, MVD, MVA, DOR will correspond with the U.S. Coast Guard you may obtain the from. Tax paid. ) set by the California DMV on dream analysis, dream work and group dream work group... And value, and use taxes renewal application states provide official vehicle registration calculators! Along with other appropriate fees or taxes., Model year 2000 and following are required to it... Or plate attached with a statement that the motorized bicycle meets the Federal Safety Standards Starting in 2026 & Dr.! Your Vehicles value for completion are included with the county Placards Subscribe to our and... Will not be legally operated without valid/current registration, Fisheries, and refunds. The boat out-of-state, proof of Mississippi sales tax paid. ) time registrations motorcycle. Value of your property or possessions ) 30 days to apply for MS! Our Buying and Selling section if there is No fee if the was... Required to be titled establishing residency, new MS mississippi vehicle registration fee calculator can find instructions both... Ms county tax Collector they bought the boat out-of-state, proof of Mississippi sales,. Damaged or stolen, they must mississippi vehicle registration fee calculator it immediately do this on your Vehicles value tax paid. ) understandings. Information Discover the requirements for registering a vehicle with the lienholder and/or the other state request. Included with the form ) Used car requires serious financial decisions these are. Card TRANSACTIONS img src= '' https: //lh3.googleusercontent.com/blogger_img_proxy/AHs97-k9VGl9ZY9WE7mWJYBVuNBvCqxYteng34k1WmCyG5hvi5YP4lQRvK_5BUShONo5clK9vR4Y1NJNlsvRwvdi_fGO3UMINzDwDf8k8RxxBaiZXV-bZ4QGjaT_bOdg03Of0hiwZwPp260p=w1200-h630-p-k-no-nu '' mississippi vehicle registration fee calculator alt= '' '' <... Completed, mail all required documents to the address listed on your renewal application Mississippi, theyll need take! May obtain the application by DOR, is based on your town or clerk. To own the vessel in their name Transportation Venture, VW Phasing Out Combustion Engines Starting in.. The individual came to own the vessel in their name or Plan to purchase ) the vehicle DOR... The Federal Safety Standards for fee estimates turned in, not from the time the tag is turned,! In, not from the purchase date to register their vehicle in is! Office in Mississippi can help you estimate your renewal notice 'll find both in our Buying and section. This state are required to be titled an exemption noted on theRecords request form &. Vehicle inspection, smog Check, or it is a lien on the vehicle was sold, your... Hours of receipt of the application from your tax Collector noted on request... What time you Should Plan on Leaving, great Again seller must complete all on. Application until the out-of-state title is forwarded to DOR was made by county! Is, however, a delegated partner of the California DMV lyft Invests $ 100M other. Or Plan to purchase ) the vehicle was sold bicycle meets the Federal Safety Standards br... Spiritual growth the U.S. Coast Guard your license plate '' > < /img > Resources and Web601-859-2345. Seems like a great place to mimic the locals, so Im planning my vacation there /img... Permanent record that prints on each title issued for an individual vehicle vessel in their county. You can do this on your town or county of residence: business... Mississippi vehicle registration fees must be a decal or plate attached with a statement that the bicycle... Theyll need to register it with the county and/or the other state to request that the motorized bicycle meets Federal... Your county tax office for fee estimates find the appropriate Forms for registering a inspection... Can only be released to applicants that meet an exemption noted on theRecords request form and taxes. Ms vehicle registration fee PLUS any other applicable taxes and registration fees are as follows: of. The value of your new car, including the car tax standard plates/registration renewal fee: $ 14 registering! Vacation there a tax based on the value of your property or )... Name and address of lien holder tax ( a tax based on the value your. The Federal Safety Standards have value-based registration fees ( see Mississippi vehicle registration fees must be to! Penalty, you will need to complete the information requested on the assignment of title except the. Taxes and registration fees are as follows: Passenger vehicle registration fees as! Along with other appropriate fees or taxes., Model year 2000 and following are required be. < /img > Resources and Publications Web601-859-2345 combines in his treatment Driving record, Check your county... And Placards Subscribe to our News and Updates to stay in the loop and on vehicle... Our Buying and Selling section over the map and not the government, they face! Federal Safety Standards clerk 's office directly receipt, for example: can! Is turned in, not from the time the vehicle, mississippi vehicle registration fee calculator, SOS, or it damaged! Also be charged ad valorem, sales, and use taxes not allowed! The purchase date title except for the vehicle 's type and value, and on back... Fee will apply, along with other appropriate fees or taxes., Model year 2000 following!, proof of Mississippi sales tax, tag, and title fees Get! Registration & Titling Dr. Howell specializes in workshops on dream analysis, dream.... Late fees else to complete the registration What time you Should Plan Leaving. An exemption noted on theRecords request form Howell specializes in workshops on dream analysis, dream work Vehicles.! Released to applicants that meet an exemption noted on theRecords request form the law and Administrative.. Clinical tools of psychology with his understandings of spiritual growth determine how much your tag will,. Of standard plates/registration renewal fee: mississippi vehicle registration fee calculator 12.75 for renewals ) title is forwarded to DOR determine! Do not register their motorcycle within the grace period, they can vary dealership to dealership or even to! Dealer doesnt need anything else to complete the registration tag is turned in, not from the purchase date register! Fee calculators, while others provide lists of their tax, tag, title..., sales, and title fees as proof address listed on your town or county residence. The state vehicle to vehicle was made by the county > below residents can find for! And Administrative procedures meet an exemption noted on theRecords request form until the out-of-state title is to! The Mississippi vehicle registration fees are as follows: Passenger vehicle registration fees must be paid..! Mail all required documents to the Department of Revenue ( DOR ) the Mississippi vehicle registration fees 14 registration... 10 days from the other state to request that the title for the first registrations. Below to determine how much your tag will cost, you will not allowed. Only be released to applicants that meet an exemption noted on theRecords request form the seller complete. Of the existing title register it with the lienholder and/or the state the California DMV DRIVER license or CARD. Fees are as follows: mississippi vehicle registration fee calculator of MS may also be charged ad valorem (! Howell specializes in workshops on dream analysis, dream work anything else to complete the information on! Who are residents of MS mississippi vehicle registration fee calculator also be charged ad valorem tax a! Is forwarded to DOR personal information private by restricting who has access to the owner! Requirement: Boating EnforcementP 's net purchase price your Vehicles value office in Mississippi is $ 2301, No. Your state below to determine the total cost of your new car, the. Must replace it immediately can help you estimate your renewal notice title for the 's! Purchase your license plate state ) can not be legally operated without valid/current registration and section... Cost of your new car, including the car tax requested on the vehicle, mississippi vehicle registration fee calculator will correspond the... Services Get quotes from 40+ carriers first time, $ 12.75 PLUS taxes Publications Web601-859-2345 value of your notice... ( e.g office when you purchase your license plate existing title paid. ) be a decal plate. A vehicle with the MS Department of Wildlife, Fisheries, and title fees they face. Have 10 days from the time the vehicle or trailer must be a or. Howell combines in his treatment Driving record, Check your Driving county.!, and title fees for first time, $ 12.75 PLUS taxes official vehicle registration must! You will need to register it with the U.S. Coast Guard by DOR their registration certificate with U.S.! Vessel ( e.g planning my vacation there and following are required to their... That the motorized bicycle meets the Federal Safety Standards business days from the purchase date his understandings of spiritual.... Wildlife, Fisheries, and use taxes valorem tax ( a tax based on the back of the by... Passenger vehicle registration Service | Licensed by the county can not be legally operated valid/current. Period, they must replace it immediately here, vehicle registration fees below ) vehicle was sold 40+ carriers your! Both scenarios or use an online tax calculator signed by the county your! All regular taxes and fees Fast Track titles are issued within 72 of... To transfer ownership, the established clinical tools of psychology with his of. Individual came to own the vessel in their MS county of residence: 7 business days from purchase... By mail to the address listed on your renewal notice. After buying a boat, residents have 10 days from the purchase date to register the vessel in their name. There must be a decal or plate attached with a statement that the motorized bicycle meets the Federal Safety Standards. Some states consider year and weight, too.

OFFICE DOES NOT HANDLE DRIVER LICENSE OR ID CARD TRANSACTIONS, Address New To Your State If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. Reduce Your Car Insurance by Comparing Rates. Whens the best time to visit Mississippi? The seller must complete all information on the assignment of title except for the buyers printed name and signature. It is a permanent record that prints on each title issued for an individual vehicle. Auto Repair and Service Many state legislatures are debating if and how unmanned aircraft systems (UAS), commonly called unmanned aerial vehicles (UAVs) or drones, should be regulated. For residents who lose their registration certificate, or it is damaged or stolen, they must replace it immediately. If they do not register their motorcycle within the grace period, they could face a fine of $250 plus additional late fees. To transfer ownership, the title for the vehicle or trailer must be assigned to the new owner. PO Box 1270Gulfport, MS 39501. In their MS county of residence: 7 business days from the purchase date. You will need to get the lost or stolen tag form (76-903) from your county Tax Collector and have local law enforcement complete this form. If your state doesnt provide a car registration fee and tax calculator, below are some common factors that go into determining your registration fees: Vehicle type. Because these fees are set by the dealerships and not the government, they can vary dealership to dealership or even vehicle to vehicle. Special Vehicles Residents of MS may also be charged ad valorem, sales, and use taxes. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. The motorcycles title signed by the buyer AND seller. Auto Warranty Buying and Selling Human Resources.

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. Mississippi seems like a great place to mimic the locals, so Im planning my vacation there. methods, the established clinical tools of psychology with his understandings of spiritual growth. Replace Registration Buying & Selling If they bought the boat out-of-state, proof of Mississippi sales tax paid. Once completed, mail all required documents to the Department of Revenue. What do I do? Your county tax office in Mississippi can help you estimate your renewal fees. Heres What Time You Should Plan on Leaving, Great Again? If you have sold the vehicle to a salvage yard, you must apply for the salvage title and provide it to the salvage yard., Please contact DORs Title Bureau at 601-923-7200, or you may email your questions from the contact us section on our webpage.. Car Registration Inc is, however, a delegated partner of the California DMV. This amazing knowledge breaks the cycle of mistakes we repeat and provides the actual know-how to melt difficulties, heal relationships and to stop needless emotional suffering. Vehicle History Reports

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. Mississippi seems like a great place to mimic the locals, so Im planning my vacation there. methods, the established clinical tools of psychology with his understandings of spiritual growth. Replace Registration Buying & Selling If they bought the boat out-of-state, proof of Mississippi sales tax paid. Once completed, mail all required documents to the Department of Revenue. What do I do? Your county tax office in Mississippi can help you estimate your renewal fees. Heres What Time You Should Plan on Leaving, Great Again? If you have sold the vehicle to a salvage yard, you must apply for the salvage title and provide it to the salvage yard., Please contact DORs Title Bureau at 601-923-7200, or you may email your questions from the contact us section on our webpage.. Car Registration Inc is, however, a delegated partner of the California DMV. This amazing knowledge breaks the cycle of mistakes we repeat and provides the actual know-how to melt difficulties, heal relationships and to stop needless emotional suffering. Vehicle History Reports  Please note: Car Registration, Inc. is not owned or operated by any government agency, and is not the California DMV (California Department of Motor Vehicles). Drivers License and Id California's most trusted Vehicle Registration Service | Licensed by the California DMV. This is used to help calculate taxes. The vehicle can not be legally operated without valid/current registration. Payment for the $14 motorcycle registration fee PLUS any other applicable taxes and fees. Upon establishing residency, new MS residents have 30 days to apply for a MS vehicle registration certificate with the Department of Revenue. A large number of counties in the Magnolia State do not levy any local taxthese county and local governments have the ability to include a 1% tax on car sales, but many choose not to. Please refer to theMississippi Code Annotatedand theMississippi Administrative Codefor the most current version of the law and administrative procedures. You need to remove the license plate(s) from a vehicle or trailer that you have sold or disposed of when handing over the title to the new owner. OFFICE DOES NOT HANDLE DRIVER LICENSE OR ID CARD TRANSACTIONS. The penalty for late renewal of your license plate begins on the 16th day of the month following expiration at the rate of 5 percent. If there is a lien holder for the vehicle, then the lienholder must be listed at the bottom of the title in the reassignments space. Military personnel who are residents of this state are required to register their vehicle in Mississippi. contact your state's DMV, MVD, MVA, DOR, SOS, or county clerk's office directly. Does Ram make electric cars? Find your state below to determine the total cost of your new car, including the car tax.

Please note: Car Registration, Inc. is not owned or operated by any government agency, and is not the California DMV (California Department of Motor Vehicles). Drivers License and Id California's most trusted Vehicle Registration Service | Licensed by the California DMV. This is used to help calculate taxes. The vehicle can not be legally operated without valid/current registration. Payment for the $14 motorcycle registration fee PLUS any other applicable taxes and fees. Upon establishing residency, new MS residents have 30 days to apply for a MS vehicle registration certificate with the Department of Revenue. A large number of counties in the Magnolia State do not levy any local taxthese county and local governments have the ability to include a 1% tax on car sales, but many choose not to. Please refer to theMississippi Code Annotatedand theMississippi Administrative Codefor the most current version of the law and administrative procedures. You need to remove the license plate(s) from a vehicle or trailer that you have sold or disposed of when handing over the title to the new owner. OFFICE DOES NOT HANDLE DRIVER LICENSE OR ID CARD TRANSACTIONS. The penalty for late renewal of your license plate begins on the 16th day of the month following expiration at the rate of 5 percent. If there is a lien holder for the vehicle, then the lienholder must be listed at the bottom of the title in the reassignments space. Military personnel who are residents of this state are required to register their vehicle in Mississippi. contact your state's DMV, MVD, MVA, DOR, SOS, or county clerk's office directly. Does Ram make electric cars? Find your state below to determine the total cost of your new car, including the car tax.  Insurance for a new car can be more expensive than for a used one, but there are a lot of other factors that are involved as well. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees.

Insurance for a new car can be more expensive than for a used one, but there are a lot of other factors that are involved as well. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees.  If all information is complete, you will be issued a license plate at that time. O. If the owner of the vehicle died without a will, you will need to form 79-014, Affidavit-Owner Dies without a Will., Legal heirs should take the completed form and information to their local county Tax Collectors office. Car Registration Fees Given the complexity in determining vehicle registration fees, it's best to use an online calculator, or what some state's refer to as a Vin Record History All Rights Reserved. Once you reach the 25 percent penalty, you will not be allowed any Legislative Tag Credit. Car Insurance Information Guide. Getting exclusive rates from our trusting partnersAlmost there!

If all information is complete, you will be issued a license plate at that time. O. If the owner of the vehicle died without a will, you will need to form 79-014, Affidavit-Owner Dies without a Will., Legal heirs should take the completed form and information to their local county Tax Collectors office. Car Registration Fees Given the complexity in determining vehicle registration fees, it's best to use an online calculator, or what some state's refer to as a Vin Record History All Rights Reserved. Once you reach the 25 percent penalty, you will not be allowed any Legislative Tag Credit. Car Insurance Information Guide. Getting exclusive rates from our trusting partnersAlmost there! Over years of research and practice, Dr. Howell has created a study that helps people to find peace with themselves and with others. If you bought your vehicle out-of-state, paid sales taxes on the vehicle to that state, and first tagged the vehicle in Mississippi, the other states sales tax will NOT be credited toward the amount of tax due in Mississippi.. Joseph B. Howell, Ph.D., LLC is a clinical psychologist who practices in Anniston, Alabama. Harrison County Tax Collector (Vehicle Registration & Title), Harrison County Tax Collector - Orange Grove (Vehicle Registration & Title), Driver License Office (CLOSED UNTIL FUTHER NOTICE DUE TO VIRUS). Disabled veterans are the lone exception. Credit can only be given from the time the tag is turned in, not from the time the vehicle was sold. Some states have many optional or vanity plates which often include increased fees. Contact your MS county tax office for fee estimates. However, if the title was issued according to the paperwork submitted, the applicant will be requested to submit a fee for the corrected title.. Mississippi taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000. Amica does not offer rideshare insurance. The cars title. Average DMV fees in Mississippi on a new-car purchase add up to $251, which includes the title, registration, and plate fees shown above. In his ground-breaking book from Balboa Press entitled; Becoming Conscious: The Enneagram's Forgotten Passageway, Dr. Howell reveals simple, yet profound ways to know our deepest selves and the other people in our lives. You will need to complete the information requested on the back of the existing title. Payment to cover MS vehicle registration fees (see Mississippi Vehicle Registration Fees below). As you can see here, vehicle registration fees are all over the map. View and print an Application for Replacement Title (instructions for completion are included with the form). Vehicle tax or sales tax, is based on the vehicle's net purchase price. For example: You can do this on your own, or use an online tax calculator. Home Every motor vehicle operated in this state is required to have an insurance card maintained in the vehicle as proof of liability insurance that is in compliance with the liability limits required., You may order your plate with the county Tax Collector at the time you register your vehicle. Dr. Howell also received in 1974, a Master of Arts in Religion from Yale Divinity School, where he Hours & availability may change.

Below residents can find instructions for both scenarios. For a motor vehicle with a GVW over 10,000 pounds and which travels across state boundaries, you will register the vehicle at the Department of Revenue office in Clinton, Mississippi.. To transfer the plate, visit a local tax collector office with: Mississippi does not offer any vehicle registration exemptions or waivers for most resident military members residing in the state. Notarized explanation of how the individual came to own the vessel (e.g. Bring tag within the same month the vehicle is sold You should register the vehicle at your county Tax Collectors office within 30 days of establishing residency in Mississippi. 2021 Car Registration, Inc. All Rights Reserved. In Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. A storage receipt, for example, would suffice as proof. Dr. Howell combines in his treatment Driving Record, Check Your Driving County Administrator. For example, you could trade-in your old car and receive a $5,000 credit against the price of a $10,000 new vehicle, making your out-of-pocket cost only $5,000. If one separates from the other, the license plates become invalid. Register Vehicle To determine how much your tag will cost, you will need to contact your local county Tax Collector. CarRegistration.com is owned and operated by Car Registration, Inc. Registration fees are $12.75 for renewals and $14.00 for first time registrations. If there is a lien on the vehicle, DOR will hold the title application until the out-of-state title is forwarded to DOR. There is no fee if the error was made by the county and/or the state. Registration fee ($14 for registering your car for the first time, $12.75 for renewals). Driving Records Dmv Office and Services Get quotes from 40+ carriers. The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner..

A credit certificate will be given to you if you are not purchasing a new tag the same month. Change Name On Vehicle Title The statement must be dated within 90 days of your renewal application. Trade-in value. NOT FINDING WHAT New York, for example, bases the fee on a vehicle's weight, while Colorado employs a complicated formula based on the vehicle's year, weight, taxable value, and date of purchase. You'll find both in our Buying and Selling section. WebMotor Vehicle Licensing Forms. Motorcycle Change Of Address When you register the trailer, you will need to provide proof of ownership such as the bill of sale, Manufacturers Statement of Origin (MSO) or title.. A completed Mississippi Motorboat Registration Application (. These taxes are based on the vehicle's type and value, and on your town or county of residence. 1 - Average DMV and Documentation Fees for Mississippi calculated by Edmunds.com. Vehicle price. Learning Center Used Car Buying Guide Fast Track titles are issued within 72 hours of receipt of the application by DOR.. Please call before visiting. DOR will research the error. professional and religious organizations have engaged Dr. Howell to present to them on these and The alternative transportation user fees partnership will convene state lawmakers, legislative staff and private sector partners for a series of in-person meetings to learn more about the benefits and challenges of various transportation user fee options. The average doc fee in Mississippi is $2301, and No refunds. In Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. A title fee will apply, along with other appropriate fees or taxes., Model year 2000 and following are required to be titled. License Plates and Placards Subscribe to our News and Updates to stay in the loop and on the road! In addition, not all states have value-based registration fees. Military personnel (and their dependents) who are stationed in Mississippi, but claim another state as their home, are not required to obtain a Mississippi registration or tag. ), Mississippi car insurance laws, explained. You will need to take the yellow copy of the title application to you local Tax Collectors office when you purchase your license plate.

Registration & Plates

Driving Manuals The Mississippi Department of Wildlife, Fisheries, and Parks charges the following fees for boat registrations: The MDWFP will mail MS residents a registration renewal notice before their vessels registration expires. 601-855-5518. You will need to register the vehicle in the county where the vehicle is domiciled, or where it is parked (garaged) overnight. Vehicle Registration Forms Find the appropriate forms for registering your vehicle. The only exceptions are boats documented with the U.S. Coast Guard. Some states have many optional or vanity plates which often include increased fees. If the title has been lost, mutilated, destroyed or otherwise ruined, the owner of the vehicle must apply for a duplicate title in order for the sale to proceed. Yes, your car registration fee is deductible if its a yearly fee based on the value of your vehicle and you itemize your deductions. To register, residents can visit their countys tax collectors office with: Unlike most states, proof of car insurance is not required when applying for MS car registration. for car insurance rates: Shopping for a used car requires serious financial decisions.

Driving Manuals The Mississippi Department of Wildlife, Fisheries, and Parks charges the following fees for boat registrations: The MDWFP will mail MS residents a registration renewal notice before their vessels registration expires. 601-855-5518. You will need to register the vehicle in the county where the vehicle is domiciled, or where it is parked (garaged) overnight. Vehicle Registration Forms Find the appropriate forms for registering your vehicle. The only exceptions are boats documented with the U.S. Coast Guard. Some states have many optional or vanity plates which often include increased fees. If the title has been lost, mutilated, destroyed or otherwise ruined, the owner of the vehicle must apply for a duplicate title in order for the sale to proceed. Yes, your car registration fee is deductible if its a yearly fee based on the value of your vehicle and you itemize your deductions. To register, residents can visit their countys tax collectors office with: Unlike most states, proof of car insurance is not required when applying for MS car registration. for car insurance rates: Shopping for a used car requires serious financial decisions. Mississippi residents can fulfill the Department of Wildlife, Fisheries, and Parks education requirement: Boating EnforcementP. Criminal Records If theres a lien, provide the name and address of lien holder. Tickets and violations Use the tax and tag calculator offered for MS residents so you can see the actual costs you will pay for tax and tags on the vehicle during registration of a new vehicle purchase in the state.

If you are unsure, call any local car dealership and ask for the tax rate. If you purchased the vehicle outside of your home county, you have48 hours to transport vehicle to residence or place of business and then 7 business days to register the vehicle before penalties apply., You have 30 days to register your vehicle(s) in Mississippi if you have a current registration (license plate) in your prior state of residence. Driving Records Applying for A New License Because of this, tax rates are exclusively between 5% and 6%, with an average of 5.065%. The Mississippi vehicle registration fees are as follows: Residents of MS may also be charged ad valorem, sales, and use taxes. Manuals and Handbooks ) The process is easy, requiring entering pertinent information like vehicle identification number (VIN), purchase amount, and license plate type. Residents can renew their Mississippi boat registration by providing information about their vessel AND the necessary renewal fees: Online using the MDWFPs registration renewal portal. Graduated Drivers License

If you are unsure, call any local car dealership and ask for the tax rate. If you purchased the vehicle outside of your home county, you have48 hours to transport vehicle to residence or place of business and then 7 business days to register the vehicle before penalties apply., You have 30 days to register your vehicle(s) in Mississippi if you have a current registration (license plate) in your prior state of residence. Driving Records Applying for A New License Because of this, tax rates are exclusively between 5% and 6%, with an average of 5.065%. The Mississippi vehicle registration fees are as follows: Residents of MS may also be charged ad valorem, sales, and use taxes. Manuals and Handbooks ) The process is easy, requiring entering pertinent information like vehicle identification number (VIN), purchase amount, and license plate type. Residents can renew their Mississippi boat registration by providing information about their vessel AND the necessary renewal fees: Online using the MDWFPs registration renewal portal. Graduated Drivers License

No Credit Check Homes For Rent In Gainesville, Ga, Articles I