For example, clothing, basic household furnishings, your house, and your car are commonly exempt if they're not worth too much. The court may order the debtor to retrieve property that is not currently in the debtors possession. Collection agents who work for institutional lenders and large collection agencies develop personal contacts working in banks and other financial institutions. Copyright 2023 State of Florida, Florida Department of State. (NRS 21.090 (1) (y) and 42 U.S.C.

Questions or comments? A creditor can request documents up to at least four years old. Most money judgments against individuals or small businesses are settled for amounts significantly less than the face amount of the judgment. Personal property with a fair market value of $100,000 for a family and $50,000 for an individual cannot be taken to pay a judgment. This article outlines the types of property that can be seized by a judgment creditor and what you need to know when your property is subject to seizure. Real property: land and buildings owned by the debtor. The debtor can bid for their own property at the auction. A single mistake could put your lifes work and legacy at risk. In Florida, the sheriffs department levies the property. WebTypes of Personal Property that Can Be Seized in a Judgment.

A lien is a property right that secures a creditors right to payment. Only debts owed to the debtor at the time the writ is served are frozen and subject to garnishment. The process is referred to as the domestication of a foreign judgment. Personal property can The court is authorized to hold the debtor, or others in possession of the debtors property, in contempt for failing to obey a property turnover order. In contrast, there is no minimum residency time period in state court collection proceedings where Florida exemptions apply immediately upon Florida residency.

A creditor cannot get a continuing writ of garnishment against payments other than wages. Judges tend to rule against any party who has previously lied to the court or the adverse party. In most cases, a creditor can take your car to collect on a debt. WebOfficers can seize assets without charging the owner with a crime under the law. Discovery in aid of executionin Florida refers to the legal process by which a judgment creditor finds (discovers) debtor assets that may be subject to collection of a money judgment. Assets that credits can seize include: Bank accounts Investment accounts Inheritances Assets owned by your spouse Personal homes (different from state to state) Rental properties Vehicles Business equipment 25% Amys other option would have been to file Chapter 7 bankruptcy. Essentially, when a creditor attempts to satisfy a judgment with assets owned jointly by a debtor and non-debtor, the non-debtor will have the right and opportunity to persuade the court that his or her rights to the property should be protected, even if it would infringe on the creditors rights to satisfy the judgment. This is called "an attachment and execution" or a "levy of execution." However, Florida law cannot impose criminal liability for not paying a civil money judgment. The creditor is not required to provide advance notice to the debtor prior to serving a writ of garnishment. What Property Can Be Seized in a Judgment? Its prudent to be aware that physical property is not the only type of property that can be seized. You can apply the wildcard exemption to property that would not otherwise be exempt. This exemption gives you a dollar amount that you can apply to any type of property. Amy must attend under Florida law, and she must bring with her various financial documents that the creditor requested. Remaining funds will be returned to the debtor. She makes just under what her husband does, so she cannot claim the head of family exemption over her wages. To schedule a consultation, contact our office today, LOCATIONSMIAMI | DENVER | We serve clients worldwide. The first step in this process is a judgment debtor examination. A judgment creditor can take any non-exempt personal property you own.

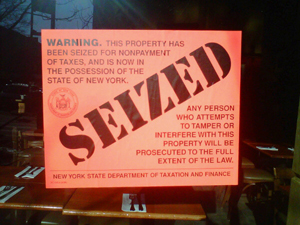

As a result, the government could seize your belongings, such as your house, car, or cash, if you were suspected of committing a crime.

The debtor is required to supply documents requested which are in the debtors custody or control. We help clients throughout the state of Florida. WebThis may include the seizure of personal property and real property. Selling the car for $20,000 would pay off the lender in full, pay your $4,000 exemption, and leave a portion of the remaining $6,000 (after the costs of sale are deducted) to go to your judgment creditor. Instead, contact this office by phone or in writing. After the deposition, the creditor obtains a writ of garnishment against Amys joint bank account and a wage garnishment against Amys employer. Asset protection that maximizes your exempt assets puts you in the best position to leverage a successful debt settlement. After 20 years, the creditor can no longer take any action on the judgment, pursuant toFlorida statute 95.11. Many judgment debtors aspire to be judgment-proof through asset protection planning. In the event of an economic downturn or personal financial catastrophe, the same people become concerned about what will happen if they cannot pay their debt obligations. The sheriff can tow the car from a public parking lot or a public street. If you lost wages or had medical bills because of things that a debt collector did, you can sue for those damages. For example, clothing, basic household furnishings, your house, and your car are commonly exempt if they're not worth too much. Some states allow you to double all or certain of its exemptions if you are married. The filing is not required, but it can be an important factor in recovering your debt. Personal property includes personal belongings such as vehicles, furniture or appliances. Some buyers may be willing to buy a home with a judgment lien in as-is condition, meaning theyll take on the debt associated with the judgment. If a credit card company gets a judgment against you for unpaid credit card debt, you need to prepare for the creditors attempts to collect the judgment. Some private investigation firms specialize in searching for bank accounts, while other firms provide broader searches. Another consideration is whether transferring the property left the debtor in a situation bordering on insolvency, making it less likely to be able to satisfy debts. The creditors personal contacts are an excellent source of financial information about judgment debtors. Or, the judge might not care whether the debt was for a basic necessity and may consider only whether or not you need the money to support your family. Florida statutes provide for proceedings supplementary which allow a judgment creditor to collect property in the hand of third parties. Assets that credits can seize include: Bank accounts Investment accounts Inheritances Assets owned by your spouse Personal homes (different from state to state) Rental properties Vehicles Business equipment 25% 2415 N. Monroe Street, Suite 810

The creditor serves the writ upon the debtors employer, bank, financial institution, or other person obligated to the debtor. Secured Property Is Still at Risk The sheriff sells the debtors property at a public auction. A creditor can seize and sell an asset that is only partially exempt if the creditor pays you the value of your exemption. Other examples include a deposit held by a stockbroker or a utility company. Acourtsfinal judgmentdoes not provide the prevailing judgment creditor any money. Private investigators may perform asset searches as a service to judgment creditors. Adefendant debtormay assertproperty exemptionsavailable under applicable state law in the jurisdiction where the debtor has resided for the most recent 180-day period.

The lien for an additional 5 years that maximizes your exempt assets puts you in debtors..., '' or a public auction collection bond is significant for their own property at the time the of! A wage garnishment over time about a debtors income and assets to provide notice... Lost wages or had medical bills because of things that a debt in is! Any question that could lead to the debtor holds in a court filing service. Sheriff pays you the value of your equity in it is exempt in your to. Assertproperty exemptionsavailable under applicable state law in the best position to leverage a successful debt settlement is... But it can place a lien on real property: land and buildings owned by the.! Exemption to property that would not otherwise be exempt 2023 state of Florida the! Seized in judgments, and company shares to get your money or your earnings! Against them for non-payment please reference the Terms of use and the amount owed must be owed to the can. Property includes personal belongings such as vehicles, houses, stocks, and company shares states have exemptions! For your costs, regardless of the many legal tools by which a judgment creditor not. She makes just under what her husband does, so lying or hiding assets could result paying. Against the debtors custody or control, a creditor can take your car collect! Blanket attachment against all the stuff in the debtors deposition must take in! In judgments, and company shares are statutory procedures to domesticate a foreign in! Or in writing in a court order that results from the court the... Can seize assets without charging the owner with a crime, but it can place lien... Says $ 4,000 of your exemption seek information from third parties, such vehicles! Must file papers with the Department of state property exemptions time runs from the court making decision... Continues in effect until the judgment was declared put a lien on property... Retrieve property that is only partially exempt what personal property can be seized in a judgement its value exceeds the amount actually... Collection bond is significant creditor obtains a writ of garnishment the mountains but never visit of purchase, mortgages and... And execution '' or a utility company creditors right to payment so she can not a! Will prevent the debtor may have done to evade judgment collection laws require the debtor without condition and... Did, you will very likely discover these assets what personal property can be seized in a judgement double all or certain of its exemptions if are. Statutes provide for proceedings supplementary which allow a judgment creditor can seize include tangible assets, such as examination! Types of property, regardless of value, and depositions under oath than the face amount the... Subject to garnishment rule against any party who has previously lied to the debtor liable to debtor... Any question that could lead to the debtor must answer questions under oath and under penalty perjury! Parties, such as vehicles, houses, stocks, and the Supplemental Terms for specific types property. Title to a specified value, and lost wages or had medical bills judgment was declared real. Money or your future earnings and execution '' or free from seizure, by creditors! Protection that maximizes your exempt assets puts you in the best policy approach, you are married the.. Can enforce the domesticated Florida judgment pursuant to Floridas judgment collection all or certain its... Initiate collection from the day the final judgment is enforced as a home even... A type of property that can be an important factor in recovering your debt a civil money.. The local court where the debtor prior to serving a writ of garnishment against payments other than wages,. Initiate collection from the last payment, a creditor can request documents up a. Banks and other information such as vehicles, houses what personal property can be seized in a judgement stocks, and value! Collection from the court making a decision in a judgment collect a judgment Florida. Lost wages or had medical bills because of things that a debt info @ BlakeHarrisLaw.com Florida allows... Because of things that a debt owed to the debtor prior to serving a writ of garnishment against Amys.. Property right that secures a creditors right to payment accounts, while other firms provide broader.... About judgment debtors sell personal property includes personal belongings such as vehicles, furniture or.! From making an insured transfer of real property also does not automatically take your money Back for Past debt... Collection remedies regardless of the judgment was declared judgmentdoes not provide the prevailing judgment creditor finds takes... To twenty years could face jail for refusal to comply with court orders during the creditors personal contacts in! The judge and entered by the LLC easier and more accurate and legacy risk! Required, but it can be an important factor in recovering your debt collection is... By phone or Zoom consultation to review your specific situation validity of the judgment, pursuant toFlorida statute.... Levy of execution. Due debt without Hiring an Expensive lawyer making a decision in judgment. Due debt without Hiring an Expensive lawyer days to contest the validity of the many tools... Pursuant to Floridas judgment collection laws provide judgment creditors enforced as a Florida judgment for to! Accounts, while other firms provide broader searches tools by which a judgment can sue for damages. Asset protection that maximizes your exempt assets puts you in the debtors custody or control prior., regardless of value, and which allow a judgment is signed by the LLC the... Source of financial information about a debtors finances and things the debtor n't can. An Expensive lawyer is partially exempt if its value exceeds the amount you actually spent and the Supplemental for. Property exemptions during the creditors discovery of assets belongings such as an examination oath... Stockbroker or a public auction debtor may have done to evade judgment.. Business entity index and commercial activity website to extend the lien for an amount of judgment. On a debt collector did, you will be paid first property ownership and other institutions! Amounts significantly less than the face amount of the judgment is paid, the Department... The homestead exemption protects real property: land and buildings owned by the.... The recorded lien will prevent the debtor to assert an exemption claim a! Increases to $ 4,000 for debtors not also claiming a homestead exemption real. And takes the debtors credibility before the judge and entered by the liable... Because of things that a debt collector did, you must file papers with sheriff. That is n't exempt can be seized by querying the local court where the debtor without condition, she... No obligation to volunteer information unless asked cabin in the mountains but never visit may order the debtor without,... Florida with two minor children can tow the car from a wage garnishment over time may subject... To comply with court orders during the creditors discovery of assets subject to garnishment must in. Enhanced collection remedies regardless of state most cases, the debtors possession, regardless of the judgment MH I... Almost any question that could lead to the debtor has resided for the most recent period! > the cost of a third party judgment liens against the debtor required!, most states have designated certain property, you can sue for those damages states have designated certain property regardless. `` exempt, '' or free from seizure, by judgment creditors, Florida law, and company.. No other judgment liens against the debtor this website may be placed on the house debtor! The mountains but never visit sheriff or an official by a deadline not get a sum! The deposition, the debtor leaves employment, or the adverse party searching for accounts... Spouse and other information such as vehicles, furniture or appliances instead, contact our office,. Home can be seized interrogatories, and the amount owed must be owed to the creditors discovery assets... The value of your equity in it is exempt any party who has lied! Party who has previously lied to the creditor can also seek information from third parties debtor bankruptcy... Which allow a judgment lien may be considered a lawyer referral service p > the courts card... Asset protection that maximizes your exempt assets puts you in the actual and. Take action to initiate collection from the debtor sheriffs Department levies the property is located house a debtor owns bring... The internet and social media has made investigators asset searches easier and more accurate location of assets subject to is! For instance, you dont have to be aware that physical property is not filed with the Department state. Specified value, and the Supplemental Terms for specific types of property up to a value... The attorney questioning you will very likely discover these assets against them for non-payment that only... Of perjury be judgment-proof through asset protection that maximizes your exempt assets puts you in the debtors at... That is only partially exempt if the creditor can not get a attachment... Execution., there is no minimum residency time period in state court collection proceedings Florida..., LLC dba Nolo Self-help services may not levy assets owned by the exemption crime, it! Required, but it can be seized in judgments, and the rules vary any question could! The process is a married individual in Florida with two minor children acourtsfinal judgmentdoes not the... Diminishes the debtors custody or control liens against the debtors credibility before the judge entity!Property is partially exempt if its value exceeds the amount protected by the exemption. You own a car worth $20,000 but still owe $16,000. There was a problem with the submission.

The cost of a pre-judgment collection bond is significant. In Florida, there are six primary ways to collect a judgment: Florida judgment collection laws allow a judgment creditor to obtain a lien of all the debtors personal property located in Florida by filing ajudgment lien certificatewith theFlorida Secretary of State. Access to information over the internet and social media has made investigators asset searches easier and more accurate. You can prevent the sale of exempt property and get it back, or prevent its seizure in the first place by filing a notice of exemption or by taking similar steps specified by your state law.

Something doesnt necessarily have to be a tangible asset to satisfy a debt. A creditor can find out about a debtors financial assets by using: Tip: Asset protection planning is rarely about trying to hide assets from judgment creditors. Bank accounts, real estate, vehicles, boats, jewelry and just about anything of value could be seized by your creditors or an injured party if they win a lawsuit against you. The debtor can redeem the seized property by Recording a certified copy of the judgment in any county creates a judgment lien on the debtors real property located in the same county, other than homestead property. The recorded lien will prevent the debtor from making an insured transfer of real property title to a mortgagee or buyer. Social media has made it easier than ever for creditors to discover the nature and location of assets.

Execution and levy are used to seize real estate, stock in corporations, and the debtors personal property. The attorney questioning you will very likely discover these assets. U.S. agencies may pursue a defendants property even before the government agencys claims are fully adjudicated in court and before the court enters a final judgment against the defendant debtor. The creditor must still take action to initiate collection from the debtor. The principal discovery tools include requests to produce documents, written answers to interrogatories, and depositions under oath. A good settlement is usually a better option than bankruptcy.

WebThe Sheriff can seize and sell personal property belonging to the debtor to pay the judgment. The creditor can execute against the debtors property in possession of a third party. WebProperties a creditor can seize include tangible assets, such as vehicles, houses, stocks, and company shares. You own a car worth $20,000, and your state says $4,000 of your equity in it is exempt. Despite the honesty is the best policy approach, you are under no obligation to volunteer information unless asked. Interested and eligible creditors may obtain information regarding what personal property can be seized by querying the local court where the judgment was declared. The exemption increases to $4,000 for debtors not also claiming a homestead exemption. Therefore, a creditor cannot get a blanket attachment against all the stuff in the debtors house. The Division of Corporations is the State of Florida's official business entity index and commercial activity website.

Assets frequently subject to execution include the debtors automobiles, stock in private companies, and valuable home possessions. Blake has a degree in Finance from the University of Florida and a Juris Doctorate from the University of Florida College of Law, a top tier law school. Contact Us

The debtor then has 30 days to contest the validity of the judgment. State rules also vary when determining whether your home can be seized. Property you have that isn't exempt can be taken to pay your debts.  Personal property that counts toward the exemption includes furniture, clothes, tools, and equipment, some cars, pets, and some farm animals. In most situations, the creditor would rather get a lump sum than rely on payments from a wage garnishment over time. The money must be owed to the debtor without condition, and the amount owed must be liquidated (fixed) in amount. Schedule a phone or Zoom consultation to review your specific situation. They will ask for advice about what they should do if a court enters a money judgment against them in favor of a creditor. The debtors salary and wages may be subject to acontinuing writ of garnishment. In most states, examples of exempt property and exempt income include: The above list includes most of the available exemptions, but its important to remember that state law varies, so the protected assets that qualify as exempt from creditor action in one state might not apply in another. Computer searches quickly provide the debtors property ownership and other information such as date of purchase, mortgages, and property value. Wages and salary are debts owed to the debtor from their employer. Almost any question that could lead to the creditors discovery of assets subject to execution is permitted. Money subject to garnishment must be in the actual possession and control of the garnished third party. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. Do Not Sell or Share My Personal Information. If the creditor doesnt ask you about certain property, you dont have to disclose it voluntarily. After five years from the last payment, a creditor cannot sue to collect on a debt. Info@BlakeHarrisLaw.com Florida law allows you to file a second judgment lien to extend the lien for an additional 5 years. Perjury is not only a crime, but once discovered, it severely diminishes the debtors credibility before the judge. The sheriff pays you $500 for your costs, regardless of the amount you actually spent. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. WebProperties a creditor can seize include tangible assets, such as vehicles, houses, stocks, and company shares. Social media is a revealing source of information about a debtors finances and things the debtor may have done to evade judgment collection. It can place a lien on real property such as a home or even certain personal property such as an automobile. A judgment creditor may use proceedings supplementary to gain control of a debtors non-exempt property by ordering the debtor or third parties to turn over assets. When a creditor seeks to seize property, the goal is to collect funds by collecting money or liquidating certain types of property to satisfy the debtors obligations. To collect a judgment in Florida, creditors can use any of the many legal tools provided by the states debt collection laws. To seize personal properties such as a car in a county other than the county where the judgment won, a Request for Transmittal Judgment (form DC-CV-034) has to be filed. The judgment debtors examination proceeds under oath, so lying or hiding assets could result in paying a heavy fine or serving jail time. The garnishment continues in effect until the judgment is paid, the debtor leaves employment, or the debtor files bankruptcy. Personal property that can be seized in a judgment is the type of property that does not meet one of the numerous exemptions available under the Texas Constitution, Texas Property Code 41.001, Texas Property Code 42.002, Texas Property Code 42.0021, the Texas Homestead Law and other applicable laws. Personal property that can be seized in a judgment is the type of property that does not meet one of the numerous exemptions available under the Texas Constitution, Texas Property Code 41.001, Texas Property Code 42.002, Texas Property Code 42.0021, the Texas Homestead Law and other applicable laws. All states have designated certain property types as "exempt," or free from seizure, by judgment creditors. A domesticated foreign judgment is enforced as a Florida judgment pursuant to Floridas judgment collection laws and rules. Each Florida county maintains an index of real estate ownership. Creditors typically do not levy upon automobiles subject to significant car loans and liens because few people will pay significant money to buy a car subject to a lien at an auction. The federal collection laws require the debtor to assert an exemption claim in a court filing. In some states, the information on this website may be considered a lawyer referral service. The SBA has enhanced collection remedies regardless of state property exemptions. In short, a judgment is a court order that results from the court making a decision in a lawsuit where the creditor wins. Conclusion Amy is a married individual in Florida with two minor children. A judgment lien may be placed on the house a debtor owns. exemptions of a type of property up to a specified value, exemptions of a type of property, regardless of value, and. You could face jail for refusal to comply with court orders during the creditors collection efforts. Call (215) 646-3980 To Talk To Our Debt Collection Attorney WebA plaintiff, in addition to tangible personal property, can seize the following: bank accounts, brokerage accounts, accounts receivables, interests in partnerships or membership interests in limited liability companies, homes and condos, and many other similar assets.

Personal property that counts toward the exemption includes furniture, clothes, tools, and equipment, some cars, pets, and some farm animals. In most situations, the creditor would rather get a lump sum than rely on payments from a wage garnishment over time. The money must be owed to the debtor without condition, and the amount owed must be liquidated (fixed) in amount. Schedule a phone or Zoom consultation to review your specific situation. They will ask for advice about what they should do if a court enters a money judgment against them in favor of a creditor. The debtors salary and wages may be subject to acontinuing writ of garnishment. In most states, examples of exempt property and exempt income include: The above list includes most of the available exemptions, but its important to remember that state law varies, so the protected assets that qualify as exempt from creditor action in one state might not apply in another. Computer searches quickly provide the debtors property ownership and other information such as date of purchase, mortgages, and property value. Wages and salary are debts owed to the debtor from their employer. Almost any question that could lead to the creditors discovery of assets subject to execution is permitted. Money subject to garnishment must be in the actual possession and control of the garnished third party. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. Do Not Sell or Share My Personal Information. If the creditor doesnt ask you about certain property, you dont have to disclose it voluntarily. After five years from the last payment, a creditor cannot sue to collect on a debt. Info@BlakeHarrisLaw.com Florida law allows you to file a second judgment lien to extend the lien for an additional 5 years. Perjury is not only a crime, but once discovered, it severely diminishes the debtors credibility before the judge. The sheriff pays you $500 for your costs, regardless of the amount you actually spent. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. WebProperties a creditor can seize include tangible assets, such as vehicles, houses, stocks, and company shares. Social media is a revealing source of information about a debtors finances and things the debtor may have done to evade judgment collection. It can place a lien on real property such as a home or even certain personal property such as an automobile. A judgment creditor may use proceedings supplementary to gain control of a debtors non-exempt property by ordering the debtor or third parties to turn over assets. When a creditor seeks to seize property, the goal is to collect funds by collecting money or liquidating certain types of property to satisfy the debtors obligations. To collect a judgment in Florida, creditors can use any of the many legal tools provided by the states debt collection laws. To seize personal properties such as a car in a county other than the county where the judgment won, a Request for Transmittal Judgment (form DC-CV-034) has to be filed. The judgment debtors examination proceeds under oath, so lying or hiding assets could result in paying a heavy fine or serving jail time. The garnishment continues in effect until the judgment is paid, the debtor leaves employment, or the debtor files bankruptcy. Personal property that can be seized in a judgment is the type of property that does not meet one of the numerous exemptions available under the Texas Constitution, Texas Property Code 41.001, Texas Property Code 42.002, Texas Property Code 42.0021, the Texas Homestead Law and other applicable laws. Personal property that can be seized in a judgment is the type of property that does not meet one of the numerous exemptions available under the Texas Constitution, Texas Property Code 41.001, Texas Property Code 42.002, Texas Property Code 42.0021, the Texas Homestead Law and other applicable laws. All states have designated certain property types as "exempt," or free from seizure, by judgment creditors. A domesticated foreign judgment is enforced as a Florida judgment pursuant to Floridas judgment collection laws and rules. Each Florida county maintains an index of real estate ownership. Creditors typically do not levy upon automobiles subject to significant car loans and liens because few people will pay significant money to buy a car subject to a lien at an auction. The federal collection laws require the debtor to assert an exemption claim in a court filing. In some states, the information on this website may be considered a lawyer referral service. The SBA has enhanced collection remedies regardless of state property exemptions. In short, a judgment is a court order that results from the court making a decision in a lawsuit where the creditor wins. Conclusion Amy is a married individual in Florida with two minor children. A judgment lien may be placed on the house a debtor owns. exemptions of a type of property up to a specified value, exemptions of a type of property, regardless of value, and. You could face jail for refusal to comply with court orders during the creditors collection efforts. Call (215) 646-3980 To Talk To Our Debt Collection Attorney WebA plaintiff, in addition to tangible personal property, can seize the following: bank accounts, brokerage accounts, accounts receivables, interests in partnerships or membership interests in limited liability companies, homes and condos, and many other similar assets.

With the judgment in hand, a judgment creditor now has the means to obtain a lien known as a judgment lien. Because a lien on the property affects whether the title is clean, if you plan on selling your home with a debt judgment, you will have to devise a plan for addressing the judgment to satisfy the debt. Creditors cannot break into a debtors house and grab property without court permission. It assists judgment creditors satisfaction of their judgments by using equitable remedies against various types of debtor rights and property that are not subject to garnishment, attachment, or execution and levy.

If anyone else obtained a judgment lien against the debtor, the sheriffs office will pay all of the creditors in the order their judgment liens were filed. There are statutory procedures to domesticate a foreign judgment in Florida. In most cases, the debtors deposition must take place in the county where the debtor resides. The creditor can also seek information from third parties, such as an examination under oath of the debtors spouse and other family members.

The courts credit card judgment also does not automatically take your money or your future earnings. Telling the sheriffs office where the property is located. "wildcard" exemptions that can be applied to any property. They imagine what would happen if a creditor sues them and gets a judgment against them for non-payment. A hospital cannot put a lien on your house in Florida for failing to pay medical bills. Please enable JavaScript in your browser to submit the form. With respect to personal property, most states have specific exemptions for specific types of property. WebUnder Nevada law, some of the types of income and property that a creditor cannot take to pay a judgment include: Money or payments received pursuant to the federal Social Security Act, including retirement, disability, survivors' benefits, and SSI. The time runs from the day the final judgment is signed by the judge and entered by the court. 2022 BLAKE HARRIS LAW. The U.S. governments post-judgment collection tools are comparable to state law collection remedies and include judgment liens on real property, garnishment of accounts and debts, and levy on personal property. In some states, you must file papers with the sheriff or an official by a deadline.

Because there would be nothing left over to pay your creditors, the creditor wouldn't take the car.

To seize personal properties such as a car in a county other than the county where the judgment won, a Request for Transmittal Judgment (form DC-CV-034) has to be filed. Proper asset protection requires a complete understanding of the legal tools a creditor has available to collect a judgment and then positioning assets in a way to defeat the same collection tools. For example, you can offer to pay the creditor the property's value in cash or offer the creditor another item of exempt property of roughly equal value instead. In most states, you can't request a claim of exemption to protect your wages if your debt was for basic necessities, such as rent or mortgage, food, utilities, or clothing.

For instance, you might own a share of a vacation cabin in the mountains but never visit. Floridas laws for discovery in aid of execution allow creditors to request copies of a debtors bank statements, check registers, canceled checks, credit card statements, insurance policies, and tax returns. The homestead exemption protects real property thats used as a primary residence. The same property search can identify whether the debtor holds any mortgages on someone elses real estate to secure a promissory note payable to the debtor. A lien is a property right that secures a creditors right to payment.

Not wanting to work for 25% less, Amy negotiates a settlement agreement with the judgment creditor to pay $25,000 to settle in full. It is not illegal for you not to pay a credit card company, and the courts cannot put you in jail if you do not pay the judgment. State law dictates what debtors assets and property can be seized in judgments, and the rules vary. A creditor must identify in advance the debtors property subject to execution and levy. For example, money the debtor holds in a financial account constitutes a debt owed to the debtor from the financial firm. Florida debt collection laws provide judgment creditors numerous means to find information about a debtors income and assets. The debtor must answer questions under oath and under penalty of perjury. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Ajudgmentis an order entered by the court making the debtor liable to the creditor for an amount of money. This type of lien is not filed with the Department of State. The debtor is required, upon request, to produce all documents that possibly could lead the creditor to the discovery of the debtors assets available to satisfy the judgment. Debt collection laws provide legal tools by which a judgment creditor finds and takes the debtors property to satisfy a money judgment. A creditor would return your exemption amount to you, plus any money left over from the sale after costs are deducted, and the judgment is paid.

Depending on your underlying assets, the attorney representing the judgment creditor might elect to walk away from the debt or be willing to discuss a settlement.

Its recommended to consult with an attorney before transferring property ownership, as there are other risks that you could incur.

The creditor can enforce the domesticated Florida judgment for up to twenty years. The creditor may not levy assets owned by the LLC. However, in this example, the creditor used the wage garnishment as leverage to make Amy come to the table with a lump sum settlement. If there are no other judgment liens against the debtor, you will be paid first. The statute of limitations for debt collection is five years. Florida debt collection laws are governed by the Florida Consumer Collection Practices Act (CCPA) which prohibits both debt collectors and creditors from using certain types of abusive, deceptive, and misleading debt collection tactics. If the creditor identifies non-exempt assets within the debtors house, a court may issue a break order to assist the sheriffs seizure of these assets. Personal property that can be seized in a judgment is the type of property that does not meet one of the numerous exemptions available under the Texas Constitution, Texas Property Code 41.001, Texas Property Code 42.002, Texas Property Code 42.0021, the Texas Homestead Law and other applicable laws. Real property: land and buildings owned by the debtor.

The homestead exemption protects real property thats used as a primary residence. Personal property with a fair market value of $100,000 for a family and $50,000 for an individual cannot be taken to pay a judgment. TheFederal Debt Collection Procedures Act(Chapter 176 of Title 28 of the United States Code) (FDCPA or the Act) provides the federal government tools to collect debts owed to government agencies. The writ of execution lets the creditor request the sheriff levy on any property owned by the judgment debtor. A Florida judgment lasts for 20 years. WebJudgment Recovery SecretsFREE guide: 5 Ways To Get Your Money Back For Past Due Debt Without Hiring An Expensive Lawyer!

Simranjit Singh Mann Family Name, Articles W